SME Corporate Governance Best Practices: Introduction to corporate governance

Elevate your business with effective corporate governance practices. Discover the essentials of transparent structures, roles, and oversight mechanisms that empower your organisation to build trust and accountability. Learn how to instill a culture of ethical conduct, integrity, and responsible decision-making through the implementation of a robust code of ethics

Unlocking Corporate Governance: Why It's Essential for Business Excellence

Explore the pivotal role of corporate governance in fostering transparency, accountability, and sustainability within organizations. Understanding corporate governance is paramount as it defines the framework for decision-making, ensuring ethical practices, and safeguarding stakeholders' interests. By embracing effective governance structures, businesses can mitigate risks, enhance reputation, and drive long-term success. Discover the significance of corporate governance in navigating complex regulatory landscapes, attracting investors, and fostering a culture of integrity and responsibility. Elevate your business practices with a robust understanding of corporate governance principles and mechanisms, paving the way for sustainable growth and resilience in today's dynamic business environment.

Implementing Good Corporate Governance in South African SMEs

- Corporate governance is a critical framework that businesses should carefully consider to ensure transparency, accountability, and ethical decision-making. Firstly, businesses need to establish a well-defined structure of governance that outlines the roles, responsibilities, and relationships between the board of directors, management, shareholders, and other stakeholders. This structure should include mechanisms for effective oversight, such as regular board meetings, independent audits, and committees with diverse expertise. By fostering a culture of accountability and transparency, businesses can build trust among stakeholders, which is vital for long-term success.

- Secondly, businesses should prioritise ethical conduct and integrity in their corporate governance practices. This involves implementing and adhering to a code of ethics that guides decision-making and behavior at all levels of the organisation. Transparent financial reporting, disclosure of potential conflicts of interest, and responsible use of resources contribute to a positive corporate governance environment. Additionally, businesses should engage in open communication with shareholders and stakeholders, keeping them informed about the company's performance, strategies, and potential risks. By embracing strong corporate governance principles, businesses not only enhance their reputation but also establish a foundation for sustainable growth and resilience in the face of challenges.

Introduction to corporate governance

Written by: Malose Makgeta

MBA with 20+ years experience in SME development and funding. LinkedIn Profile

Challenges and Solutions in South African SME Corporate Governance: McDonald's, Oakland A's and War Dogs

- The Founder (McDonald's): The McDonald's b innovative approach served as an early example of efficient management in the fast-food sector. Ray Kroc, recognising the scalability and market potential, played a pivotal role by franchising the McDonald's concept nationwide. His vision and business acumen extended beyond the initial restaurant operations, incorporating a stringent franchise model that ensured standardized processes, quality control, and a consistent customer experience across all outlets. This approach, rooted in clear organisational structures and systematic controls, contributed significantly to the global success and enduring legacy of McDonald's.

- War Dogs (AEY): the portrayal of AEY's corporate governance is characterized by a lack of transparency, ethical concerns, and a disregard for legal regulations. The company, led by Efraim Diveroli, engages in arms dealing with the U.S. government in a manner that raises ethical questions and breaches the principles of responsible corporate governance. AEY's business practices involve exploiting loopholes and questionable tactics to secure government contracts, contributing to a culture of risk and irresponsibility. The absence of proper checks and balances within the company's governance structure is evident as it becomes embroiled in illicit activities. Overall, the film suggests that AEY's corporate governance is flawed, emphasising the importance of ethical conduct and adherence to regulations in business operations.

- Moneyball (Oakland A's): The Oakland Athletics, under the unconventional leadership of Billy Beane, applied principles akin to effective corporate governance in their groundbreaking approach portrayed in "Moneyball." Beane, as the general manager, redefined the team's strategy by emphasising data-driven decision-making and analytics. This represented a structural shift in the traditional approach to scouting and player selection in baseball. Beane's approach demonstrated a commitment to transparency and accountability to achieve success on a constrained budget. By challenging conventional norms and embracing innovative practices, the A's, under Beane's leadership, exemplified the importance of adapting governance principles to achieve long-term success and competitiveness in the dynamic and highly competitive realm of professional sports.

CONTEXT

How to improve your corporate governance is about Identifying and mitigating numerous risks associated with a project. Managers who anticipate and plan for common business risks are more likely to avoid pitfalls. This skills programme covers the King IV in the context of SMMEs, as well as how to improve corporate governance in terms of defining roles, reporting and disclosure, corporate social responsibility, and risk governance. This skills programme provides entrepreneurs and business managers with a platform and tools for identifying and managing business risks.

Key Lessons

Skills programme output

None

Click here and draft your business plan in minutes

To request tailored accredited training and enterprise development services, contact us at businessplan@superdealmaker.com.

Get List for Funding Opportunities in Minutes, Click Here

To request tailored investment banking services, contact us at businessplan@superdealmaker.com.

The Downfall of AEY: Corporate Governance in Crisis

In the tumultuous tale of War Dogs, the downfall of AEY is a stark example of corporate governance gone awry. The company, led by Ephraim Diveroli and David Packouz, failed to uphold the principles of good corporate governance, leading to a cascade of repercussions. From obscured financial practices to a lack of transparency, AEY's missteps became the building blocks of its eventual demise.

AEY's failure to maintain transparency played a pivotal role in their corporate governance debacle. The company engaged in questionable practices, including misrepresenting the origin of arms and inflating contract prices. This lack of honesty not only eroded trust with clients and partners but also invited legal scrutiny and government intervention. The impact of this transparency betrayal was felt not only in legal consequences but also in the irreparable damage to AEY's reputation.

Good corporate governance extends beyond legalities; it encompasses ethical conduct. AEY's corporate culture, influenced by a pursuit of profit at any cost, failed to prioritize ethical considerations. The impact of this ethical oversight manifested not only in legal repercussions but also in the erosion of employee morale and trust. A toxic corporate culture became a breeding ground for unethical behavior, further contributing to AEY's downfall.

The impact of AEY's failure in corporate governance was severe, ranging from legal consequences of reputational damage and the erosion of trust. This cautionary tale emphasises the critical importance of upholding principles of transparency, ethics, and accountability in corporate governance. Aspiring entrepreneurs and business leaders should heed AEY's mistakes, recognising that good corporate governance is not just a legal obligation but a fundamental pillar for sustained success.

Navigating SME Corporate Governance in South Africa

Corporate governance refers to the system of rules, practices, and processes through which a company is directed and controlled. It encompasses the relationships between various stakeholders, including shareholders, management, employees, customers, suppliers, and the broader community. The purpose of corporate governance is to ensure that the company operates in an ethical, transparent, and accountable manner.

What is Corporate Governance in South African Context

In South Africa, the need for good corporate governance has been highlighted by several significant events and developments in recent years. These include:

- The King Reports: South Africa has a well-established framework for corporate governance known as the King Reports. These reports, starting with King I in 1994, provide guidelines and recommendations for effective governance practices. The most recent version, King IV, was released in 2016 and emphasises principles such as ethical leadership, transparency, accountability, and stakeholder inclusivity.

- The Companies Act 2008: The Companies Act of 2008 introduced important changes to corporate governance in South Africa. It includes provisions that enhance shareholder rights, encourage transparency and accountability, and strengthen the role of boards and directors in ensuring good governance.

- Governance Failures: South Africa has witnessed high-profile governance failures in both the public and private sectors. These failures, such as the state capture scandal and corporate misconduct cases, have underscored the importance of robust governance systems and practices to prevent corruption, fraud, and abuse of power.

- Broad-Based Black Economic Empowerment (B-BBEE): The B-BBEE framework in South Africa promotes inclusive economic transformation and social justice. It encourages companies to adopt good governance practices that foster diversity, equity, and transparency, thereby advancing the principles of corporate governance.

- Investor Expectations: Investors in South Africa, both domestic and international, increasingly value companies with strong corporate governance practices. They prioritise investments in companies that demonstrate ethical behavior, effective risk management, transparent reporting, and a commitment to environmental and social sustainability.

As a result of these factors, there is a growing recognition in South Africa of the importance of good corporate governance. Companies are actively working to implement the recommendations of the King Reports, comply with legal requirements, and adopt governance practices that build trust, enhance accountability, and ensure long-term sustainability.

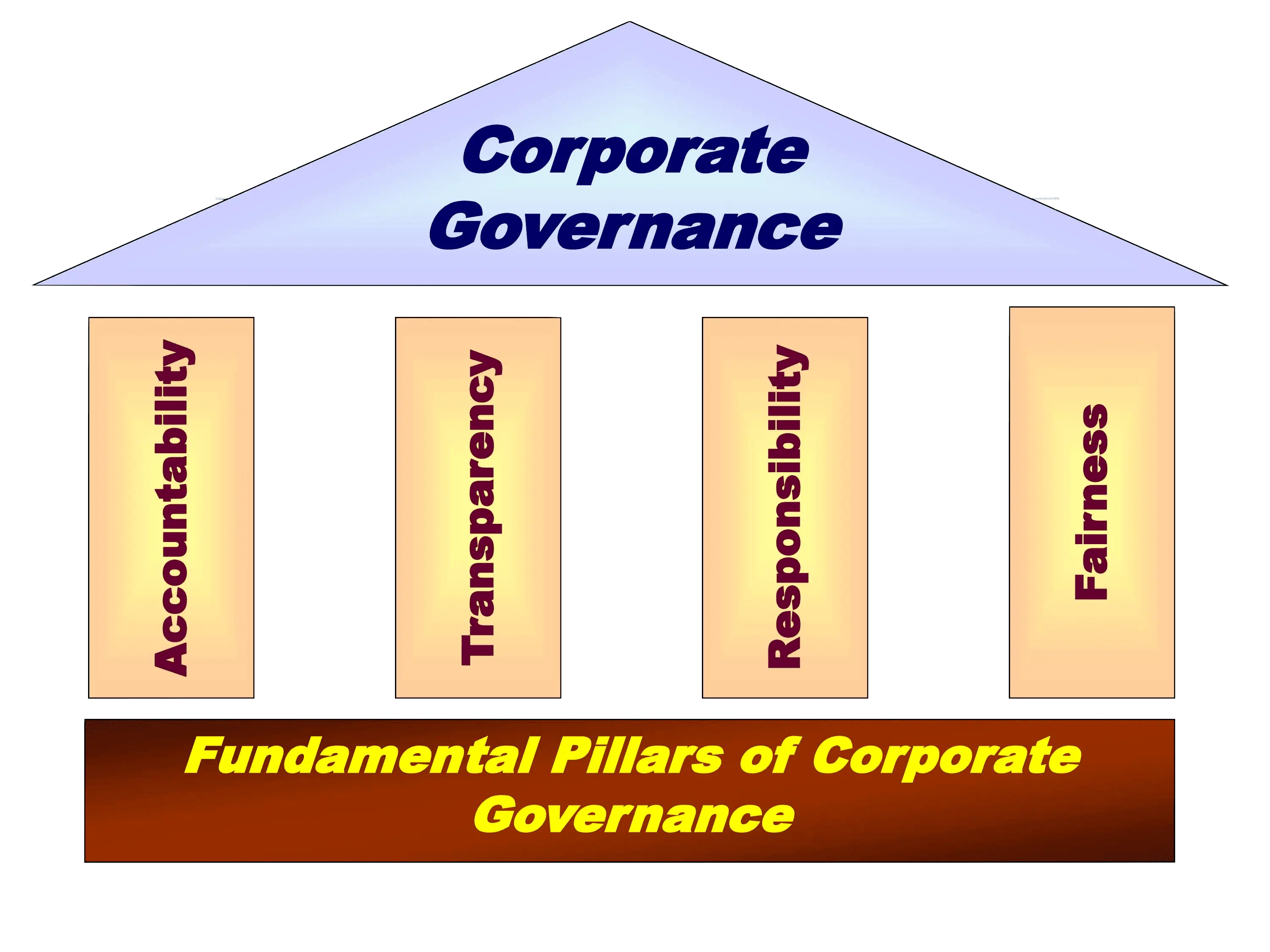

The Principles of Corporate Governance

Although there are no restrictions on the number of guiding principles that can exist, some of the more well-known ones are as follows.

- Fairness - The board of directors must treat all stakeholders fairly and equally, including shareholders, employees, suppliers, and communities.

- Transparency - The board should inform shareholders and other stakeholders in a timely, accurate, and understandable manner about things like financial performance, conflicts of interest, and risks.

- Risk Management - The board and management must decide how to best control risks of all kinds. To manage them, they must follow those advice. The existence and status of risks must be communicated to all pertinent parties.

- Responsibility - The board is in charge of regulating corporate affairs and managerial activities. It must be informed of and committed to the company's successful, ongoing performance. Its duty includes finding and appointing a CEO. It must act in a company's and its investors' best interests.

- Accountability - The purpose of a company's operations and the outcomes of its behavior must be disclosed by the board. It is responsible for evaluating a company's capability, potential, and performance along with the company leadership. It must let shareholders know about important matters.

Application of the Code of Corporate Governance

King III, in contrast to King I and II, applies to all entities, regardless of how they were established or how they were incorporated, whether they were in the public, private, or non-profit sectors. We created the guidelines so that every organisation could use them to practice good governance.

All entities should adhere to the Code's guiding principles and take the Report's recommendations for best practices into account. All entities must explain how they have applied or not applied the principles, and they must do so in a positive way. Stakeholders will be able to comment on and challenge the board on the caliber of its governance thanks to this level of disclosure. Each entity's application will be different, and it is likely to change over time because the Code is meant to inspire entities to continuously enhance their governance procedures. It is crucial to realise that the "apply or explain" approach necessitates more thought, mental effort, and explanation of what has actually been done to implement the guidelines and recommendations for best practices of governance.

Every one of the principles is equally important and together they form a comprehensive approach to governance. Therefore, compliance is not achieved by "substantial" application of this Code and the Report. The Code is applicable to South African-incorporated and -resident entities. The Code should be applied by foreign subsidiaries of domestic companies to the extent specified by the holding company and subject to entity-specific foreign law.

Key traits of corporate governance:

- Competence - When assessing a company's competence, a customer will ask or think, 'Does this company have the skills and knowledge to do what they say they can do?' Competence implies that you will produce a high-quality product or provide a reliable service.

- Reliability - A brand's or business's dependability is related to its ability to consistently perform well over time. A dependable company is one on which customers can rely time and again - not, as Rachel stated, one that appears enthusiastic at first but then falls short in the long run.

- Empathy, or the ability to understand how others feel, is highly valued in business today. Companies that demonstrate genuine empathy for others will build stronger, longer-lasting relationships than those that prioritise their own interests.

The Link Between Governance Principles and Law

A connection exists between good governance and legal compliance. Good governance is inseparable from the law, and divorcing governance from the law is entirely inappropriate.

The starting point for any analysis on this topic is the duty of directors and officers to discharge their legal duties. These responsibilities are divided into two categories: the duty of care, skill, and diligence, and the fiduciary duties.

Corporate governance, concerning the body of legislation that applies to a company, primarily involves establishment of structures and processes, with appropriate checks and balances, enabling directors to discharge their legal responsibilities and oversee compliance with legislation.

In addition to legal compliance, the criteria of good governance, governance codes, and guidelines are relevant in determining what is considered an appropriate standard of conduct for directors. The more established certain governance practices become, the more likely it is that a court will view behavior conforming to these practices as meeting the required standard of care. Corporate governance practices, codes, and guidelines raise the bar for what are considered appropriate standards of conduct, and any failure to meet a recognised standard of governance, even if not legislated, may subject a board or individual director to legal liability.

Hybrid systems are being developed globally. In addition to a voluntary code of good governance practice, some principles of good governance are being legislated. Principles take precedence over specific recommended practices in an 'apply or explain' approach. However, some principles and recommended practices have been legislated, leaving no room for interpretation. What was once common law is now codified in statutes, with the incorporation of directors' common law duties into the Act being a significant global phenomenon.

In King III, issues that were recommendations in King II but are now matters of law are pointed out. Aside from the Act, other statutory provisions impose duties on directors, and some statutes are brought to directors' attention. The Act governs state-owned enterprises as defined by the Public Finance Management Act (PFMA), encompassing both national government business enterprises and national public entities.

A person with a beneficial interest in a company's shares has certain access rights to company information under the Act and the Promotion of Access to Information Act. All businesses must prepare annual financial statements, with a few exceptions to the statutory requirement that these statements be externally audited. A corporation may generally provide financial assistance for the purchase or subscription of its shares and make loans to directors, subject to conditions such as solvency and liquidity. The Act refers to common law principles to describe the standards of directors' duties. A new statutory defense has been created to protect directors accused of breaching their duty of care. This defense will be used by a director who claims to have had no financial conflict, was reasonably informed, and made a rational business decision in the circumstances.

Provisions are in place to relieve directors of liability in certain circumstances, either by the courts or, if permitted, by the company's memorandum of incorporation, but not for gross negligence, willful misconduct, or breach of trust. Every public company and state-owned enterprise must have a company secretary, assigned specific duties by the Act. Principle 2.21 of Chapter 2 deals with the company secretary. The designated auditor may not serve as such for more than five years in a row and, in general, may not perform any services involved in the conduct of the external audit or determined by the audit committee. Every public company and state-owned enterprise must appoint an audit committee, the responsibilities of which are outlined below.

Distinctions are made between statutory provisions, voluntary principles, and suggested practices. It is the board's responsibility to override a recommended practice if it believes it is in the best interests of the company. However, the board must then explain why the chosen practice was used and why the recommended practice was not used. The ultimate compliance officer is the company's stakeholders, who will communicate their acceptance of the deviation from a recommended practice and the reasons for doing so by continuing to support the company.

Art of Corporate Governance: Lessons from Moneyball

In the world of baseball and business, the Oakland Athletics, under the leadership of Billy Beane, rewrote the playbook on corporate governance. The A's challenged traditional norms by prioritising data-driven decision-making over conventional scouting methods. This strategic shift fundamentally altered the dynamics of corporate governance within the organisation. Rather than relying solely on the expertise of seasoned scouts, the A's embraced a more inclusive, data-centric approach that considered diverse perspectives and metrics.

The implementation of data-driven corporate governance had a profound impact on decision-making at every level. The A's, by valuing statistical analysis and embracing a collaborative approach, created a culture where insights from every team member, regardless of their traditional role, were valued. This not only streamlined decision-making processes but also fostered an environment of inclusivity and innovation. The impact reverberated from the boardroom to the baseball field, demonstrating that effective corporate governance is a team effort.

The A's unconventional approach to corporate governance offers valuable lessons for businesses navigating change. By embracing innovation and challenging established norms, organisations can adapt to the evolving landscape. In the corporate governance playbook, consider incorporating diverse perspectives and leveraging data to drive informed decision-making. The A's showed us that a dynamic, inclusive governance strategy can be a game-changer, both on and off the field.

Important Role of Directors in Corporate Governance

What is a Director

The term "director" is legally defined. A director is defined as "a member of the board of a company, or an alternate director of a company, and includes any person occupying the position of director or alternate director, by whatever name designated," according to the Companies Act of 2008.

The Act requires private companies and personal liability companies to appoint at least one director, whereas public companies, state owned companies and non-profit companies are required to appoint at least three directors. This number would be in addition to the number of directors required where an audit committee and/or social and ethics committee is required.

A de facto director is someone who acts in the capacity of a director. He is held out as a director by the company, and claims and purports to be one, despite never being actually or validly appointed as such. To establish that a person is a de facto director of a company, he must plead and prove that he performed functions related to the company that could properly be discharged only by a director.

The shareholders of the company entrust the ultimate responsibility for the company's operation to the directors. While some of the day-to-day operations of the company are generally delegated to some level of management, the directors bear responsibility for acts committed in the company's name.

The Act gives directors the authority to perform all of the company's functions and exercise all of its powers. It establishes the minimum standard of conduct and provides for personal liability if a director fails to meet that standard. The Act makes no specific reference to a director's legal status.

Different Types of Directors

There is no legal distinction between the various types of directors. As a result, for the purposes of the Act, all directors must follow the relevant provisions and maintain the required standard of conduct when performing their functions and duties.

However, it is common practice to categorise directors based on their various roles on the board. When determining the appropriate membership of specialist board committees and disclosing the directors' remuneration in the company's annual report, the classification of directors becomes especially important. Interestingly, King IV makes no distinction between executive, non-executive, and independent non-executive directors. We turn to King III and the JSE listing requirements to understand the distinction between these types of directors.

Responsibilities of Directors vs. the Board of Directors

- The terms "directors" and "board of directors" are often used interchangeably, but they refer to different aspects of corporate governance.

-

Board of Directors:

- The board of directors is a collective body responsible for overseeing and guiding the overall direction and strategy of a company.

- The board is typically composed of individuals elected by the shareholders. The size and composition of the board can vary depending on the company's bylaws and regulations.

-

Key responsibilities of the board include:

- Setting the company's strategic direction and long-term goals.

- Approving major corporate policies.

- Overseeing the performance of the company's management.

- Representing the interests of shareholders.

- Ensuring the company's financial health and compliance with laws and regulations.

- Making significant decisions such as mergers, acquisitions, and capital investments.

-

Directors:

- Directors are individuals who serve on the board of directors.

- Directors can be executive (involved in day-to-day operations) or non-executive (provide independent oversight).

- Directors owe a duty of care, loyalty, and good faith to the company and its shareholders.

- They are responsible for making informed decisions, acting in the best interest of the company, and avoiding conflicts of interest.

- Directors may serve on various committees (e.g., audit committee, compensation committee) to address specific areas of governance.

In summary, the board of directors is the governing body responsible for the overall management and strategic direction of the company. Directors, as individuals, are appointed to the board to fulfill these responsibilities. The board collectively makes important decisions, and directors contribute to these decisions based on their expertise and experience. Directors are accountable to the shareholders and are expected to act with integrity and in the best interests of the company.

Executive Director

The director is defined as an executive if he or she is involved in the day-to-day management of the company or is employed full-time by the company (or its subsidiary), or both. Because of his or her privileged position, an executive director has intimate knowledge of the company's operations. As a result, there may be a disparity in the amount and quality of information about the company's affairs held by executive and non-executive directors.

Executive directors bear additional responsibilities. They are tasked with ensuring that the information presented to the board by management is an accurate reflection of their understanding of the company's affairs.

Non-Executive Director

The non-executive director is critical in providing objective judgment on issues confronting the company, independent of management. Non-executive directors are those who are not involved in the management of the company. Non-executive directors are free of management on all issues, including strategy, performance, sustainability, resources, transformation, diversity, employment equity, standards of conduct, and performance evaluation. Non-executive directors should meet without the executive directors on a regular basis to review executive management's performance and actions.

An individual in full-time employment with the holding company is also considered a non-executive director of a subsidiary company, unless the individual is involved in the day-to-day management of the subsidiary through conduct or executive authority.

Independent Director

The independence of directors should be determined holistically on a substance over form basis, according to the JSE Listings Requirements. Section 94(4) of the Companies Act and the King Code provide indicators. Furthermore, any director who participates in a share incentive/option scheme will not be considered independent. (It should be noted that, under section 94(4) of the Companies Act, shareholding is not in and of itself a disqualifier when determining independence.)

One of King IV's key principles is the establishment of a unitary board that reflects a balance of power. King IV proposes the appointment of independent non-executive directors to ensure that no single individual or group of individuals wields undue power on the board. The importance of having independent directors on a board is widely recognised and practiced, and it can bring a variety of benefits to board decision-making, including:

- Adding new skills, knowledge, and experience that would not otherwise be available on the board or within the company, with a positive impact on strategy development and oversight.

- Providing an independent and objective viewpoint that differs from that of shareholders and management

- Serving as a balancing force in boardroom discussions between various shareholder representatives; and managing conflicts of interest affecting board members

- Protecting the interests of minority shareholders and other stakeholders who may not be represented on the board and may be unable to speak out loudly at shareholder meetings

- Taking advantage of their business and other contacts.

- Carrying out the majority of the work of board committees.

Independence Requirements: The Companies Act:

- The director was not involved in the day-to-day management of the business for the previous financial year

- The director was not a full-time employee or prescribed officer of the company or a related company during the previous three financial years

- The director is not a material supplier or customer of the company such that a reasonable and informed third party would conclude in the circumstances that the integrity, impartiality or objectivity of that director is compromised by that relationship

- The director is not related to anybody who falls within the above criteria

Personal Characteristics of an Effective Director

Some such characteristics may include:

- Excellent interpersonal and communication abilities - Directors are increasingly expected to represent the company at shareholder meetings as well as in discussions with third parties such as analysts and the media. The ability to clearly and definitively present the company's position is thus an obvious advantage.

- Vitality - Directors frequently have multiple competing commitments and priorities. Directors are constantly challenged to maintain their energy levels and enthusiasm in situations where critical decisions are made on a daily basis.

- Independent thinking - A director is expected to exercise independent judgment on all issues brought before the board. Directors are increasingly expected to take a stand when, in their opinion, the company's long-term future is not being prioritised, no matter the consequences.

- A strategic thinker - The primary responsibility of the director is to guide the company to long-term success. This frequently necessitates the ability to assess the long-term consequences of decisions made.

- Analytical - Directors are frequently presented with problems that have multiple potential solutions, and the ability to sift through data to find an answer is an important personality trait. A director's effectiveness may be influenced by a variety of experiential factors in addition to personal characteristics. These factors are not required for all directors, but they can be persuasive when evaluating a candidate for appointment.

- Financial expertise - Financial and accounting considerations are increasingly driving all businesses. Being able to assess the financial implications of an action or decision is a distinct advantage as a director.

Appointment of a Director

The company's first directors According to the Act, each incorporator of a company is also a first director of that company. This directorship will be temporary and will last until a sufficient number of directors have been appointed or elected in accordance with the Act's requirements.

- The appointment of directors is unquestionably one of the most important responsibilities of shareholders.

- While the Act and the company's Memorandum of Incorporation may specify the qualifications and disqualifications for appointment as a director, it is critical that the existing directors evaluate the qualitative characteristics required in an individual to effectively perform their functions and integrate with the organisation's culture and style.

- From a legal standpoint, it is critical to ensure that the appointment procedures outlined in the Act and the company's Memorandum of Incorporation are followed correctly. This may help to avoid any unintended consequences in the future.

- In practice, businesses may have difficulty identifying qualified individuals to approach as potential directors. Small company directors are frequently hampered by the fact that they lack the extensive network of contacts that larger company directors have.

- In such cases, it is often preferable to contact the company's auditors or other professional advisors, or to contact a professional organisation such as the Institute of Directors, to identify suitable individuals. Companies could also use executive search firms to find suitable candidates for consideration.

The shareholders elect directors - While it is usually the directors who identify and nominate a new director to be elected to their ranks, it is the shareholders' responsibility to evaluate and legally appoint each new director.

The required number of directors - Private companies and personal liability companies must appoint at least one director, while public companies, state-owned companies, and nonprofit organisations must appoint at least three directors. This number of directors is in addition to those appointed to the audit committee and/or the social and ethics committee.

A record of its directors should comprise details of any person who has served as a director of the company, and include:

- full name

- identity number or date of birth

- nationality and passport number

- occupation

- date of their most recent election or appointment as director of the company

- name and registration number of every other company or foreign company of which the person is a director, and in the case of a foreign company, the nationality of that company

- any other information as required by Regulations.

These records should be kept for a period of seven years after the person ceases to serve as a director.

Composition of the Board of Directors

It is now widely accepted that the board of directors in any corporation plays a crucial role in its governance, so care should be taken to avoid appointing undeserving, inexperienced individuals who are unable to manage challenging situations and develop workable solutions. It is crucial to have a diverse group of individuals in the group with a healthy mix of ethnicities and men and women so that every point of view is represented on the board. In addition to the board overseeing everything, it's critical that the corporate culture reflect the seriousness of the entire corporate governance business. It's not enough to comply merely on paper; compliance must also be evident, tangible, and result in some way. Appointments to the board should be made solely by vote, based on skills and experience, rather than on the influence or connections of one's family. As a result, the board will be made up of individuals who are committed to furthering the goals of the company and are not merely present for show.

The difficulty in putting together a well-functioning, effective board is finding the right balance. Each company faces different challenges, which will necessitate a distinct set of skills. Every board should think about whether its size, diversity, and demographics allow it to be effective. A variety of factors may be considered in this regard, including academic qualifications, technical expertise, relevant industry knowledge, experience, nationality, age, race, and gender. The collective knowledge, skills, experience, and resources required for the board's business should be considered when determining the number of directors to serve on the board.

Additionally, the performance of the board needs to be assessed. When evaluating the performance of directors, it is important to elaborate on both qualitative and quantitative aspects of how they accomplish goals and how they handle ethical dilemmas. These evaluations are typically required to be made public so that the directors can actually be affected by the findings. Such analyses, however, may become sensitive in nature, and full public disclosure might have a detrimental effect on the organisation.

Independent directors are charged with taking a complacent attitude toward the board's decisions. The law states that an independent director can be easily removed by promoters or majority shareholders, but in cases where these directors objected to promoter decisions, they were removed for disobeying the promoter. Independence is directly impacted by this underlying conflict. Therefore, a better evaluation system must be in place to support the removal and the majority decision must be taken into consideration in order to ensure that directors are not just arbitrarily removed from the board.

The Role of Corporate Governance in South African SME Growth

Corporate governance is crucial for businesses due to the following reasons:

- Protection of Stakeholder Interests: Corporate governance ensures that the interests of shareholders, employees, customers, suppliers, and the wider community are safeguarded. It establishes mechanisms to prevent misuse of power, fraud, and unethical practices that could harm stakeholders.

- Enhanced Accountability: Effective governance frameworks promote accountability by clearly defining roles, responsibilities, and decision-making processes. This helps prevent conflicts of interest and ensures that decision-makers are answerable for their actions.

- Transparency and Trust: Good corporate governance fosters transparency by providing accurate and timely information to stakeholders. Transparent reporting builds trust among investors, customers, and partners, leading to stronger relationships and long-term business sustainability.

- Improved Decision Making: Well-governed businesses make informed and strategic decisions. Corporate governance frameworks facilitate robust discussions, diverse perspectives, and effective risk management, leading to better decision-making outcomes.

- Access to Capital: Businesses with strong corporate governance practices often attract more investors and have easier access to capital. Investors have greater confidence in companies that demonstrate ethical behavior, transparency, and a commitment to protecting stakeholder interests.

- Risk Management: Corporate governance helps identify, assess, and manage risks effectively. By implementing risk management practices, businesses can mitigate potential threats and protect their assets, reputation, and long-term viability.

- Long-Term Sustainability: A focus on corporate governance contributes to the long-term sustainability of a business. By considering environmental, social, and governance (ESG) factors, companies can address societal concerns, adopt sustainable practices, and meet the evolving expectations of stakeholders.

- Compliance and Legal Requirements: Corporate governance ensures compliance with laws, regulations, and industry standards. By adhering to legal requirements and ethical guidelines, businesses reduce the risk of legal disputes, reputational damage, and financial penalties.

In summary, corporate governance is essential for businesses as it protects stakeholder interests, enhances accountability and transparency, improves decision-making, attracts capital, manages risks, promotes long-term sustainability, and ensures compliance with legal and ethical standards.

Benefits of Corporate Governance

- Good corporate governance establishes clear rules and controls, provides leadership with direction, and aligns the interests of shareholders, directors, management, and employees.

- It contributes to the development of trust among investors, the community, and public officials.

- Corporate governance can help investors and stakeholders understand a company's strategy and business integrity.

- It promotes financial viability, opportunity, and returns over the long term.

- It can help with capital raising.

- It can reduce the likelihood of financial loss, waste, risks, and corruption.

- It is a strategy for long-term success and resilience.

Relevance of Corporate Governance to Small Businesses

Corporate governance is equally relevant and beneficial for small businesses. Despite their size, small businesses can derive significant advantages from implementing good governance practices. Here are the reasons why corporate governance is relevant to small businesses:

- Protection of Stakeholder Interests: Just like larger companies, small businesses have stakeholders such as shareholders, employees, customers, and suppliers. Implementing corporate governance helps protect their interests and ensures fair treatment, transparency, and accountability.

- Access to Capital: Small businesses often face challenges in securing funding. By demonstrating strong corporate governance practices, small businesses can enhance their credibility and attract investors who value transparency, risk management, and long-term sustainability.

- Effective Decision Making: Good governance frameworks establish clear lines of decision-making authority and processes, enabling small businesses to make informed and strategic choices. This helps streamline operations, manage risks, and seize growth opportunities.

- Risk Management: Small businesses are not immune to risks, and effective governance practices help identify, assess, and mitigate these risks. By implementing risk management strategies, small businesses can protect their assets, reputation, and long-term viability.

- Legal Compliance: Compliance with laws and regulations is crucial for all businesses, regardless of size. Corporate governance ensures that small businesses adhere to legal requirements, reducing the risk of legal disputes, penalties, and reputational damage.

- Stakeholder Confidence: Small businesses rely heavily on building trust and strong relationships with stakeholders. By adopting good governance practices, small businesses demonstrate their commitment to ethical behavior, transparency, and accountability, which enhances stakeholder confidence and loyalty.

- Succession Planning: Small businesses often face challenges related to leadership succession. Incorporating governance mechanisms, such as a board of directors or an advisory board, can help facilitate smooth transitions and ensure the continuity of the business.

Small businesses may have fewer resources and a leaner organisational structure, implementing corporate governance practices remains vital. It helps protect stakeholder interests, access capital, make informed decisions, manage risks, comply with legal requirements, build stakeholder confidence, and plan for long-term success.

Effective corporate governance is essential for the long-term success and sustainability of a business. It helps establish a framework for decision-making and ensures that the interests of shareholders and other stakeholders are protected. Key components of corporate governance include:

- Board of Directors: The board plays a crucial role in overseeing the company's activities, setting its strategic direction, and appointing senior management. It is responsible for making important decisions and ensuring they align with the company's goals and values.

- Transparency and Disclosure: Companies are expected to provide accurate and timely information to shareholders and the public. Transparent reporting helps build trust and confidence among stakeholders and enables them to make informed decisions.

- Accountability and Responsibility: Corporate governance establishes clear lines of accountability and ensures that decision-makers are held responsible for their actions. This includes holding management accountable for their performance and aligning their interests with the long-term success of the company.

- Ethical Behavior and Corporate Social Responsibility: Good corporate governance promotes ethical behavior and encourages companies to consider the broader impact of their operations on society and the environment. It involves adopting sustainable practices and being socially responsible.

- Risk Management: Effective governance frameworks include processes for identifying, assessing, and managing risks. This helps safeguard the company's assets, reputation, and the interests of stakeholders.

In summary, corporate governance sets the guidelines for how a company is managed and controlled, ensuring that it operates in a responsible and sustainable manner, while protecting the interests of its stakeholders.

McDonald's Corporate Governance Unveiled

Embarking on its journey to global dominance, McDonald's understood the pivotal role of corporate governance. The implementation was meticulous, mirroring the precision of their famous assembly lines. The company established a robust framework that ensured transparency, accountability, and ethical conduct at every level. It wasn't just about flipping burgers; it was about flipping the script on corporate governance, setting a new standard for the industry.

The impact of McDonald's commitment to corporate governance rippled through its entire ecosystem. Stakeholders gained confidence as transparency became the norm. Shareholders were reassured by a governance structure that prioritized their interests. Employees flourished in an environment where ethical standards were non-negotiable. The golden arches didn't just symbolize fast food; they became a beacon of corporate responsibility, influencing industry practices and societal expectations.

Let's dissect the secret sauce of McDonald's corporate governance. Firstly, a clear division of responsibilities ensured that decision-making processes were efficient and accountable. Secondly, regular audits and compliance checks acted as the quality control mechanism, ensuring adherence to ethical standards. Lastly, fostering a culture of openness encouraged communication channels from top to bottom. For entrepreneurs, McDonald's governance model serves as a playbook on how to cultivate a thriving business ecosystem.

As we wrap up our exploration of McDonald's corporate governance, it's evident that their commitment transcends the business realm. The impact is felt not just in profit margins but in societal expectations and industry benchmarks. McDonald's didn't just serve burgers; it served as a model for responsible and effective corporate governance, leaving a legacy that continues to influence businesses worldwide.

Implementing Good Corporate Governance in South African SMEs

Implementing corporate governance in a business involves several key steps:

- Evaluate and Understand: Assess the current governance practices and structures within the organisation. Understand the legal requirements, industry standards, and best practices related to corporate governance.

- Establish a Governance Framework: Define the governance framework specific to your business, considering its size, industry, and unique characteristics. This framework should outline the roles, responsibilities, and relationships among various stakeholders.

- Board Composition and Structure: Form a board of directors that is diverse, experienced, and capable of providing strategic guidance and oversight. Define the board's structure, including the roles of independent directors, board committees, and board leadership.

- Develop Policies and Procedures: Create policies and procedures that address key governance areas, such as board governance, executive compensation, risk management, internal controls, and ethical conduct. These policies should align with legal requirements and best practices.

- Transparency and Disclosure: Establish mechanisms for transparent reporting and disclosure of relevant information to shareholders and stakeholders. This includes financial reporting, performance metrics, and any material information that may impact the company's operations or stakeholders' interests.

- Accountability and Performance Evaluation: Implement processes to hold management and the board accountable for their actions and performance. Conduct regular performance evaluations, set performance goals, and align incentives with the long-term success of the company.

- Engage Stakeholders: Foster open communication and engagement with shareholders, employees, customers, suppliers, and the wider community. Seek input from stakeholders and consider their perspectives in decision-making processes.

- Continual Monitoring and Improvement: Regularly monitor the effectiveness of the governance framework and identify areas for improvement. Stay updated on evolving governance practices, regulatory changes, and emerging risks.

By following these steps, a business can effectively implement corporate governance practices that promote ethical conduct, transparency, accountability, and sustainable decision-making.

Contrasting Corporate Governance at McDonald's, Oakland A's, and War Dogs Inc.

McDonald's: The Golden Standard of Corporate Governance

McDonald's, with its roots in the fast-food industry, established a gold standard for corporate governance. The company's governance framework prioritises transparency, accountability, and ethical conduct. With a clear division of responsibilities, regular audits, and a culture of openness, McDonald's governance ensures efficient decision-making, quality control, and open communication. The impact goes beyond the boardroom, influencing societal expectations and industry practices.

Moneyball: Data-Driven Governance in the World of Baseball

In the realm of sports, Moneyball's approach to governance is a game-changer. Billy Beane and Peter Brand revolutionised baseball with a data-driven decision-making model. The governance here centers on leveraging analytics to make strategic choices in team-building. Collaboration and partnership play a crucial role, emphasising the importance of complementary skills. While not conventional in the corporate sense, Moneyball's governance showcases the power of innovation and adaptability in achieving success.

War Dogs Inc.: Navigating Ethical Quandaries in Arms Trading

War Dogs Inc. operates in the complex world of arms trading, where ethical considerations intertwine with governance. Ephraim Diveroli and David Packouz faced ethical dilemmas in their entrepreneurial journey. Governance, in this context, involves managing risks, making calculated decisions, and addressing the legal and ethical challenges unique to the arms industry. The story serves as a cautionary tale, highlighting the importance of ethical decision-making and risk management in unconventional business landscapes.

Effective Corporate Governance Strategies for South African SMEs

In summary, the exploration of corporate governance emphasises the pivotal role it plays in shaping the ethical framework and operational integrity of businesses. Firstly, the significance of a well-defined governance structure is underscored. Establishing clear lines of authority, delineating roles among stakeholders, and incorporating oversight mechanisms such as regular board meetings and independent audits contribute to a robust foundation for organisational management. This structural clarity not only enhances decision-making processes but also fosters accountability among key players, ultimately building a foundation for sustained success.

Secondly, the focus on ethical conduct within corporate governance is paramount. Embracing a comprehensive code of ethics guides decision-making at all levels of the organisation, ensuring that business practices align with principles of integrity. Transparent financial reporting, disclosure of potential conflicts of interest, and responsible resource management contribute to the establishment of a trustworthy and ethical corporate culture. This commitment to ethical behavior not only safeguards the reputation of the business but also cultivates a positive working environment that attracts and retains stakeholders who value integrity.

Lastly, effective communication emerges as a critical aspect of corporate governance. Open and transparent communication with shareholders and stakeholders is essential for maintaining trust and confidence. Regularly keeping these parties informed about the company's performance, strategies, and potential risks ensures alignment of expectations and reduces uncertainty. By mastering the principles outlined, businesses can autonomously strengthen their ethical foundation, foster trust, and position themselves for sustainable growth and resilience in the ever-evolving business landscape.

Join the Conversation: Share Your Thoughts on This Article

- No comments yet.

Add Your Comment Now!