SME Corporate Governance Best Practices: How to be responsible

Businesses striving for responsible corporate governance should prioritise ESG factors, encompassing environmental sustainability, social responsibility, and effective governance structures. Embracing eco-friendly practices, reducing carbon footprints, and fostering diversity and inclusion within their workforce are essential steps.

Unlocking Corporate Governance: The Path to Responsible Business Leadership

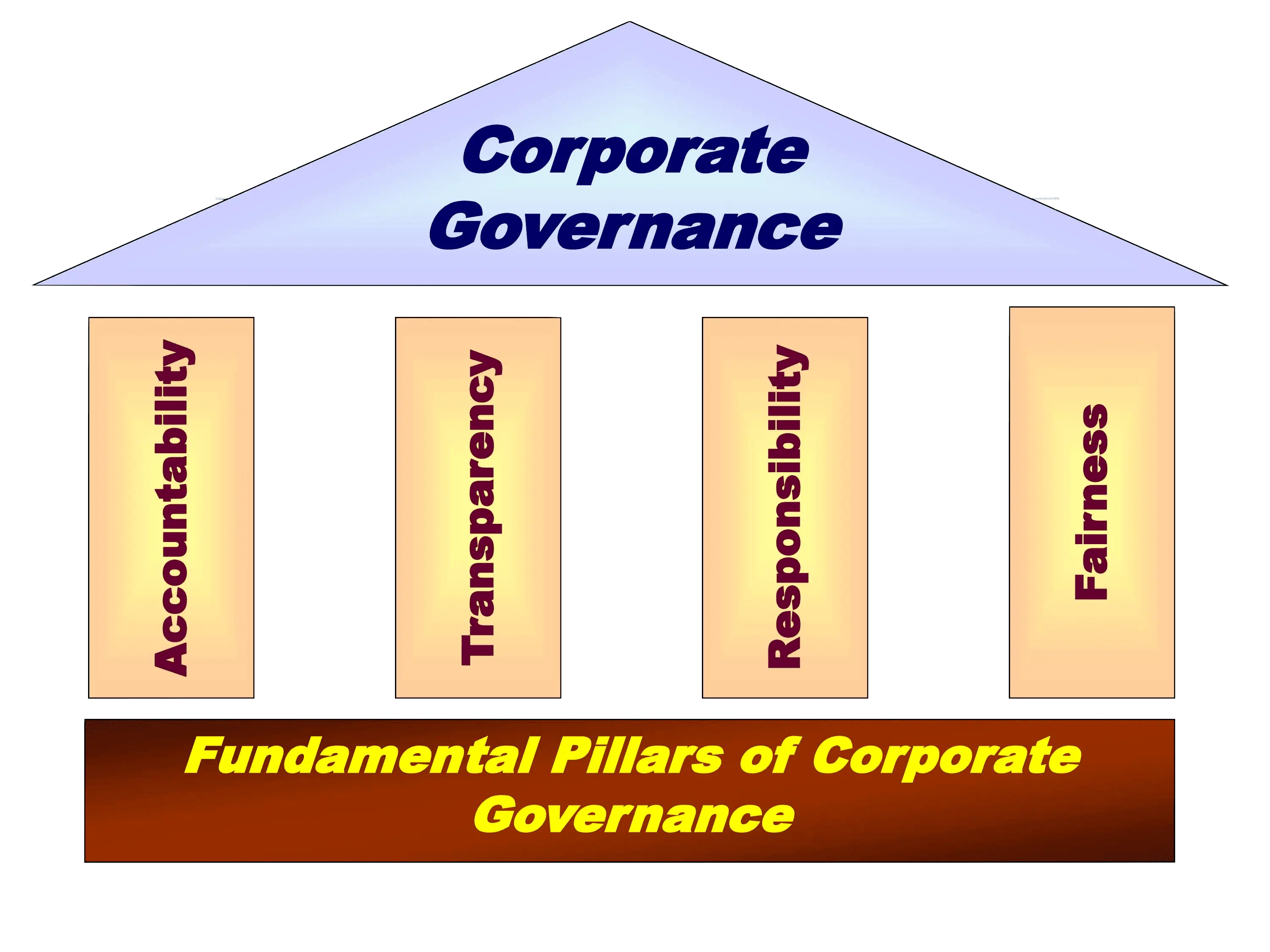

Understanding corporate governance is paramount in today's business landscape. Learn why embracing responsible practices is essential for organizational success and sustainability. From transparency to accountability, explore how strong governance frameworks foster trust among stakeholders, attract investors, and mitigate risks. Discover practical strategies to uphold ethical standards, comply with regulations, and ensure board effectiveness. Elevate your leadership by mastering the principles of corporate governance, driving positive impact, and fostering long-term value creation for your company and society.

Corporate Governance Responsibility Considerations

- Businesses should prioritise environmental, social, and governance (ESG) factors as integral components of their corporate governance. On the environmental front, companies should adopt sustainable practices, reduce their carbon footprint, and invest in eco-friendly technologies. This not only aligns with global efforts to combat climate change but also enhances a company's long-term resilience by mitigating environmental risks. Social responsibility involves fostering diversity and inclusion within the workforce, promoting fair labor practices, and contributing positively to the communities in which the business operates. Companies should prioritise employee well-being, ethical supply chain practices, and community engagement initiatives to build trust and goodwill.

- In terms of governance, transparency and accountability are crucial. Businesses must establish robust corporate governance structures, with clear lines of authority and effective checks and balances. Ethical decision-making should be at the core, with a commitment to fair business practices and integrity. Boards of directors should comprise diverse members to ensure a variety of perspectives and experiences are considered in strategic decision-making. Regular and accurate disclosure of financial and non-financial information helps build trust among stakeholders. By integrating these principles into their corporate governance framework, businesses can not only enhance their reputation but also contribute to sustainable, long-term value creation for both shareholders and society.

How to be responsible

Written by: Malose Makgeta

MBA with 20+ years experience in SME development and funding. LinkedIn Profile

Corporate Governance Responsibility: McDonald's, Oakland A's and War Dogs

- The Founder (McDonald's): The first restaurant opened by the McDonald brothers was not initially successful, leading them to redesign it into what we now recognise as McDonald's. Ray Kroc, who joined later, hadn't perfected the initial business model, nor did he have a detailed business plan. Both the McDonald brothers and Ray faced near failure because they lacked a business plan. Fortunately, they had the resources to delve deep into the business without one. If you have the resources, you can start without a business plan; otherwise, a business plan is critical.

- War Dogs (AEY): While the actions of AEY were primarily centered around arms dealing and navigating ethically ambiguous situations, it's challenging to characterise their actions as inherently responsible. The narrative illustrates the moral ambiguity and potential lack of responsibility associated with the international arms trade. AEY's focus on profit and the pursuit of lucrative government contracts leads to ethical dilemmas and legal complications. While the characters may showcase occasional concerns or moments of reflection, their involvement in the arms industry ultimately raises questions about responsible business practices and ethical considerations in the pursuit of financial gain. The film serves as a cautionary tale about the consequences of engaging in morally complex industries and the potential lack of responsibility that can accompany such endeavors.

- Moneyball (Oakland A's): Billy Beane built a successful team without a traditional business plan; instead, he made decisions as he went along and eventually stumbled upon Peter Brand, who believed in the predictive analytics system. This approach led the Oakland A's to a 20-game winning streak, breaking records in American baseball history.

- Explore further insights on business plan development lessons derived from our case study movies: McDonald's, Oakland A's and War Dogs by clicking here.

CONTEXT

How to improve your corporate governance is about Identifying and mitigating numerous risks associated with a project. Managers who anticipate and plan for common business risks are more likely to avoid pitfalls. This skills programme covers the King IV in the context of SMMEs, as well as how to improve corporate governance in terms of defining roles, reporting and disclosure, corporate social responsibility, and risk governance. This skills programme provides entrepreneurs and business managers with a platform and tools for identifying and managing business risks.

Description

Responsibility is about responsible party for the governance of their businesses. The shareholders role in governance is to appoint the directors and the auditors and to satisfy themselves that an appropriate governance structure is in place.

Purpose

Be able to oversee corporate matters and management activities. It must be aware of and support the businesss ongoing success. It must act in the best interests of the business and its investors.

Rational

Understanding corporate governance responsibility is critical for the business.

Key Lessons

Click here and draft your business plan in minutes

To request tailored accredited training and enterprise development services, contact us at businessplan@superdealmaker.com.

Get List for Funding Opportunities in Minutes, Click Here

To request tailored investment banking services, contact us at businessplan@superdealmaker.com.

The War Dogs' Misadventure: A Tale of Corporate Governance Gone Awry

In the tumultuous world of arms dealing portrayed in War Dogs, AEY, led by Ephraim Diveroli, found itself entangled in a web of irresponsible corporate governance. Ephraim's ambitious pursuit of profit often blurred ethical boundaries, leading to a lack of transparency and accountability within the company. The foundation of responsible corporate governance crumbled as AEY embraced a culture that prioritized short-term gains over long-term sustainability.

War Dogs unfolds a narrative where AEY's lack of responsible corporate governance is evident in its engagement with questionable suppliers and the flouting of legal regulations. Ephraim's pursuit of lucrative government contracts led to compromises in quality control and adherence to ethical standards. The impact of these lapses extended beyond financial consequences, tarnishing the company's reputation and jeopardising its very existence.

AEY's failure in responsible corporate governance had a profound impact on stakeholders, including investors, employees, and government agencies. The erosion of trust resulted in legal repercussions, tarnished business relationships, and financial losses. The fallout from their irresponsible actions underscored the importance of ethical conduct and adherence to corporate governance principles in sustaining a business's long-term viability.

War Dogs serves as a cautionary tale, emphasising the significance of responsible corporate governance. Entrepreneurs must recognise that ethical lapses and regulatory breaches not only jeopardize the immediate bottom line but also cast a long shadow on a company's future. As we dissect AEY's missteps, let it be a reminder that integrity, transparency, and accountability are the cornerstones of enduring success in the business world.

Corporate Social Responsibility Meaning

Responsibility refers to the ethical and accountable behavior of a company's management, board of directors, and stakeholders in fulfilling their obligations and obligations towards the organisation, its shareholders, employees, customers, and the wider society. It encompasses a range of responsibilities, including legal compliance, ethical conduct, risk management, and consideration of the interests of various stakeholders.

Key aspects of responsibility include:

- Legal Compliance: Companies have a responsibility to comply with applicable laws, regulations, and legal frameworks governing their operations. This includes adhering to financial reporting requirements, labor laws, environmental regulations, consumer protection laws, and other relevant statutes.

- Ethical Conduct: Responsibility requires companies to uphold high ethical standards. This involves conducting business with integrity, honesty, and fairness, and avoiding conflicts of interest, bribery, corruption, and other unethical practices. Ethical conduct extends to interactions with employees, customers, suppliers, and other stakeholders.

- Accountability: Responsible corporate governance entails being accountable for actions, decisions, and outcomes. This includes transparent reporting, effective internal controls, and mechanisms for holding individuals and the organisation accountable for their performance, behavior, and adherence to policies and regulations.

- Stakeholder Consideration: Companies have a responsibility to consider the interests and concerns of their stakeholders, including shareholders, employees, customers, suppliers, and the community. This involves engaging with stakeholders, understanding their needs, and making decisions that balance and prioritise their interests.

- Risk Management: Responsibility includes managing risks effectively. Companies should identify, assess, and mitigate risks that may impact the organisation, its stakeholders, and the achievement of its objectives. This includes implementing risk management processes, internal controls, and contingency plans.

- Sustainability: Responsible corporate governance involves considering the long-term sustainability of the company's operations, taking into account social, environmental, and economic factors. This includes adopting sustainable business practices, addressing environmental impacts, promoting diversity and inclusion, and contributing positively to the communities in which the company operates.

- Corporate Citisenship: Responsibility extends beyond legal and regulatory requirements. Companies have a responsibility to be good corporate citisens, contributing to the well-being of society through philanthropy, community engagement, and supporting social causes that align with their values and business purpose.

By embracing responsibility, companies demonstrate their commitment to ethical behavior, stakeholder value creation, and sustainable business practices. Responsible governance enhances trust, reputation, and long-term success for the organisation and its stakeholders.

Acknowledging mistakes and taking responsibility

People in positions of power and authority, such as elected officials, public servants, and school administrators, frequently experience pressure to avoid admitting any oversight, mistake, or fault, whether it stems from their own actions, the actions of their predecessors, or the actions of the organisations they represent.

- In many cases, this reluctance to admit mistakes or accept responsibility is an attempt to avoid legal liabilities associated with admitting fault (leaders may even be acting on the express instructions of lawyers) or to avoid the political and professional consequences of negative publicity and media attention. However, avoiding admissions of fault or avoiding responsibility—particularly in cases of outright wrongdoing or misconduct—can undermine trust in public institutions and damage local leaders' credibility.

- Leaders in organising, engagement, and equity work can build — or rebuild — trust and credibility by openly admitting past mistakes and any harm done to the community.

- Even if legal concerns limit a district's or school's ability to discuss specific topics, administrators can explain those constraints, assure the community that appropriate actions will be taken, and then provide a full and transparent accounting once a situation has been resolved.

- When public institutions refuse to admit fault or take appropriate responsibility, community leaders working outside of those institutions can mobilise students, families, and other stakeholders to demand greater accountability and transparency.

Understanding the Roles and Responsibilities of Directors

- To act within the scope of powers conferred by the Companies Act and Memorandum and Articles of Association.

- In the best possible business conduct and management

- Formulation and Execution of Corporate Strategy, Business plan, Budget, major Capital Expenditures, mergers and acquisitions, etc.

- Formulation of Succession planning

- Monitoring managerial performance, conflict of interest of management, board members.

- Assuring Return on Investment

- Corporate Social Responsibilities

- Compliance with Laws and regulations

- Adequate financial reporting and ensure adequate internal financial controls

- To develop policies and procedures

The board of directors are responsible for the governance of information and technology

These policies should be monitored in relation to:

- Integration of people, technologies, information, and processes throughout the organisation.

- incorporating technology and information risks into overall risk management.

- plans for ensuring business resilience.

- proactive intelligence monitoring to detect and respond to incidents such as cyber-attacks and negative social media events.

- managing the performance and risks associated with third-party and outsourced service providers.

- evaluating the value delivered to the company as a result of significant investments in technology and information, including the evaluation of projects throughout their life cycles and significant operational expenditure

Directors Responsibility Towards Shareholders

Shareholders are the true owners of the company because they contribute financially to its creation and growth.

Management's responsibility to them

- Maximise Return on Investment.

- Appropriate representation of shareholders in board.

- Redressal of grievances of investors.

Directors Responsibility towards employee

Most important assets of any organisation. They led to a successful enterprise from average.

Management’s responsibilities towards them

- Payment of Wages

- Participation in Profits

- Participation in decision-making

- Participation in Equity shares via ESOPs, Sweat Equity shares, bonus shares

- Safety, Hygiene & working condition

- Opportunity of growth

Directors Responsibility Towards Customers

- Offering Right product at right time at right place at right price

- Offering quality & value for the money

- Maximum Information of Product & service, enabling them to make right buying decision

- After sale Service / Grievance Redressal

Responsibility Towards Community

- Payback for what you take

- Clean and Green practices for controlling the pollution

- Payment to creditors, suppliers within time

- Following Fair trade practices

- Corporate Social Responsibility

- Investment towards sustainable business

Responsibility Towards Government

- Payment of taxes on time, fairly and honestly

- Following Anti-Corruption practices while liaising with public servants

- Participate in Government sponsored industry forums; provide policy & industry related feedbacks

Reporting Responsibilities

Integration of social, environmental and economic issues

The proliferation of sustainability-related initiatives, resources, and guidelines is proof of the issues' increased awareness. A company is regarded as a citisen of a nation just as much as a natural born citisen because of how essential it is to society. It is anticipated that the business will act responsibly toward its community and be viewed as such. These concerns touch on social, environmental, and economic issues—the triple context in which businesses actually function. Boards should no longer base decisions solely on current needs because doing so could limit future generations' ability to meet their own needs.

The natural environment, the social and political system, and the global economy are three interdependent sub-systems that are linked to the success of businesses in the twenty-first century. Global corporations are involved in all three, and they require all three for success. According to Tomorrow's Company, a UK publication. Planet, people, and profit are all intertwined in some way.

Making sustainability issues mainstream is a major challenge for leadership. Strategy, risk, performance, and sustainability are now inseparable, which is why this Report uses the term "integrated reporting."

Only if a company's leadership embraces the idea of integrated sustainability performance and reporting will best practices in sustainability and integrated reporting be achieved. In this area, there are some instances of visionary leadership. For instance, Tomorrow's Company acknowledges that the global corporation of the future needs to "expand its view of success and redefine it in terms of lasting positive impacts for business, society, and the environment."

However, sustainability is more than just documenting sustainability. Companies must prioritise integrated performance. In order for the business to achieve this integrated performance, the board's job is to set the tone at the top. Sustainability also dictates that management compensation plans shouldn't encourage maximisation of relatively immediate results at the expense of long-term performance.

Inclusive stakeholder approach

This Report seeks to emphasise the inclusive approach of governance.The board of directors should take into account the legitimate interests and expectations of stakeholders other than shareholders, according to what is known as the "enlightened shareholder" model and the "stakeholder inclusive" model of corporate governance. However, there are significant differences between how the two approaches handle the legitimate expectations and interests of stakeholders. The legitimate interests and expectations of stakeholders only serve an instrumental purpose in the "enlightened shareholder" approach. Stakeholders are only taken into account when doing so would benefit shareholders. In the "stakeholder inclusive" approach, the board of directors takes into account the legitimate interests and expectations of stakeholders on the grounds that doing so is in the company's best interests and not just as a means of advancing shareholder interests.

The integration and trade-offs between various stakeholders are then made on a case-by-case basis, to serve the best interests of the company. The shareholder, on the premise of this approach, does not have a predetermined place of precedence over other stakeholders. However, the interests of the shareholder or any other stakeholder may be afforded precedence based on what is believed to serve the best interests of the company at that point. The best interests of the company should be interpreted within the parameters of the company as a sustainable enterprise and the company as a responsible corporate citisen. This approach gives effect to the notion of redefining success in terms of lasting positive effects for all stakeholders, as explained above.

Integrated reporting

Any company listed on the JSE has a market capitalisation equal to its economic value, not its book value. A company's balance sheet and profit and loss statement, which are included in its financial report, are snapshots of its current financial situation. A buyer evaluates a company's economic value when purchasing shares on any stock exchange. The evaluation takes into account the worth of unaccounted-for factors like future earnings, brand equity, goodwill, the caliber of the board and management, reputation, strategy, and other sustainability-related factors.

The knowledgeable investor evaluates the effectiveness of the company's risk management and determines if sustainability issues that are important to its operations have been taken into account. Indirect capital is still provided by people today. They are consumers and concerned citisens who want to keep our planet sustainable. Those who create integrated reports ought to provide the readers' desired information for the future. Also seeking assurances about the accuracy of this information for the future are today's stakeholders.

An organisation can boost stakeholder confidence and trust in its operations by issuing integrated reports. Both the business opportunities and risk management of the company may increase as a result. A company can evaluate its ethics, core values, and governance by publishing an integrated report internally, and it can also increase stakeholder trust and confidence by doing so externally.

To help stakeholders evaluate a company's economic value more accurately, we have advised integrated sustainability performance and integrated reporting in King III.

The integrated report, which is used throughout the Report and is described in Chapter 9, should have enough details to document how the company has affected the economic well-being of the community in which it operated during the year under review, both favorably and unfavorably. These effects are frequently categorised as environmental, social, and governance issues (ESG). Additionally, it should include information on how the board expects to enhance the positive aspects and eliminate or ameliorate the negative aspects in the upcoming year.

Any transition to sustainability must include innovation, fairness, and collaboration. Innovation offers fresh perspectives on problems, including profitable solutions that are sustainable; fairness is essential because social injustice is not sustainable; and collaboration is frequently a requirement for significant change. However, cooperation shouldn't cross the line into anti-competitive behavior.

Emerging governance trends incorporated in the report

- Internal auditing based on risk - Risk involves problems in every aspect of running a business or enterprise. Risk is inherent in strategy because it involves dealing with upcoming events. Directors are required by King II and other similar codes to investigate a company's internal controls and, if satisfied, confirm their sufficiency in the annual report. Internal auditing should be risk-based, and every year the board should receive an evaluation from the internal auditors on the system of internal controls in general and the effectiveness of internal financial controls in particular. The audit committee is required to provide the board with a thorough report on its findings from the internal audit evaluation. This will support the integrated report's assertion made by directors regarding the effectiveness of internal controls in a company. Internal audit is a component of the combined assurance model described in this Report's Chapter 3 Principle 3.5.

- Shareholders and remuneration - We discussed the tendency for the board to submit the company's compensation policy to a non-binding advisory vote of shareholders in general meeting in the report. The board will outline the criteria for determining senior management employees' specific compensation in the remuneration policy. The compensation of non-executive directors will be set for the year and requires a special resolution from shareholders at a general meeting. Refer to Principle 2.25 in Chapter 2.

- Evaluation of board and director performance - Board, board committee, and individual director evaluation, including that of the chairman, is now ingrained on a global scale. Evaluations are covered in Chapter 2 Principle 2.22 of the Report.

- Governance of information technology - Information systems were once considered business enablers, but they are now pervasive in the sense that they are incorporated into the business strategy. Given how pervasive IT is in business today, corporate imperatives demand IT governance.

- 1.15 Business rescue - It is unusual for South Africa to lack adequate business rescue legislation. The Act now addresses this. Given the high costs to the economy if businesses fail, it is obvious that being able to save economically viable companies that are having financial difficulties is in the best interests of shareholders, creditors, employees, and other stakeholders as well as in the interests of the nation as a whole. Legislation governing business rescue must strike a balance between stakeholder rights and prevent abuse. For a long time, the business community has argued that there should be provisions for business rescue, but not just for corporations. Directors need to be aware of how to actually save a business.

- Basic and involved transactions - We weren't worried about important and consequential transactions in King I or King II. To make sure that directors are aware of their responsibilities and duties for mergers, acquisitions, and amalgamations, we have added a section on fundamental and affected transactions to the Practice Notes due to the changes made to the Act. Additionally, having a thriving takeover market encourages good governance and increases the likelihood of discipline and effective management.

- Language, terminology, and gender - Despite the use of the terms "company," "boards," and "directors," King III refers to the functional responsibility of those in charge of governance in any entity, even if other entities, sectors, and industries use different terminology. In this report, we include "she" or "her" when the Report uses the pronouns "he" or "his." Similarly, when we use the term "chairman," we also mean "chairwoman," "chairperson," and "chair." All entities fall under the definition of "corporate" when discussing corporate governance, corporate citisenship, corporate ethics, etc.

Responsibility as a Pillar of Strong Corporate Governance

Being responsible holds significant importance for organisations due to the following reasons:

- Ethical Conduct: Responsibility ensures ethical conduct and integrity within an organisation. Upholding ethical standards promotes trust among stakeholders, including shareholders, employees, customers, and business partners. It fosters a positive corporate culture and helps prevent unethical practices and reputational damage.

- Stakeholder Confidence: Responsibility enhances stakeholder confidence and trust in the organisation. When companies demonstrate responsible governance practices, stakeholders feel assured that their interests are being considered and protected. This leads to stronger relationships, increased loyalty, and greater support from stakeholders.

- Long-Term Sustainability: Responsibility contributes to the long-term sustainability of an organisation. By considering environmental, social, and governance (ESG) factors, companies can address risks, identify opportunities, and create value in a sustainable manner. Responsible practices support the organisation's resilience and longevity.

- Legal Compliance: Responsibility ensures compliance with laws, regulations, and industry standards. Companies that prioritise responsible governance minimise legal and regulatory risks, avoiding fines, penalties, and legal disputes. Compliance demonstrates the organisation's commitment to operating within the boundaries of the law.

- Risk Management: Responsibility plays a vital role in effective risk management. Responsible governance practices help identify, assess, and mitigate risks that may impact the organisation's objectives. By proactively managing risks, companies can protect their financial stability, reputation, and the interests of stakeholders.

- Enhanced Reputation: Responsibility contributes to building a positive reputation for the organisation. Companies known for responsible corporate governance are viewed as trustworthy, transparent, and socially responsible. A strong reputation attracts customers, investors, and talented employees, providing a competitive advantage in the market.

- Innovation and Adaptation: Responsibility encourages innovation and adaptation to changing societal and market expectations. By considering stakeholder needs and addressing emerging ESG challenges, companies can identify new opportunities, develop innovative solutions, and stay ahead of industry trends.

- Positive Social Impact: Responsibility enables organisations to make a positive impact on society. By integrating social responsibility into business practices, companies can contribute to sustainable development, support local communities, and address social issues. This creates a sense of purpose and aligns the organisation's goals with societal well-being.

Overall, practicing responsibility is essential for maintaining ethical standards, gaining stakeholder trust, ensuring long-term sustainability, and positioning the organisation as a responsible corporate citisen. It fosters a positive organisational culture and contributes to the overall success and resilience of the company.

Importance of Responsibility in Corporate Governance Explained: AEY, McDonald's, and the A's

AEY's Ethical Quandaries and Governance Lapses

In the arms trade depicted in War Dogs, AEY, led by Ephraim Diveroli, faced ethical challenges and governance lapses. The company's pursuit of profit often compromised transparency and accountability, leading to legal repercussions and shattered trust among stakeholders. AEY's story serves as a cautionary tale on the perils of irresponsible corporate governance and the consequences of prioritising short-term gains over long-term sustainability.

McDonald's: A Model of Innovation and Franchise Success

McDonald's, in contrast, exemplifies a success story in business innovation and responsible growth. Ray Kroc's vision and collaboration with the McDonald brothers laid the foundation for a globally recognised franchise. The company's commitment to a standardized yet adaptable model, coupled with a customer-centric approach, showcases how responsible corporate practices can lead to long-term success. McDonald's journey underscores the importance of aligning business ventures with personal passion and skills.

The A's and Moneyball: Data-Driven Decisions and Collaboration

Shifting to the baseball diamond, the Oakland Athletics, portrayed in Moneyball, showcase a different facet of corporate success. Billy Beane and Peter Brand's data-driven approach challenged traditional scouting methods, emphasising collaboration and innovation. Unlike AEY's governance lapses, the A's success lies in their commitment to strategic decision-making, leveraging data to drive performance. The partnership between Beane and Brand exemplifies the power of collaboration and the importance of adapting to changing landscapes for sustained success.

Responsibility: Foundation of Ethical Corporate Governance

To embody responsibility, organisations can adopt the following practices:

- Ethical Framework: Establish a clear ethical framework that outlines the company's values, principles, and expected behaviors. Communicate this framework to employees and stakeholders and ensure its integration into decision-making processes.

- Compliance: Ensure compliance with applicable laws, regulations, and industry standards. Implement robust compliance programs that include policies, training, and monitoring to prevent and detect non-compliance.

- Board Oversight: Foster responsible governance at the board level by appointing directors with diverse backgrounds, skills, and expertise. Encourage active board participation, independence, and accountability in overseeing the company's strategic direction, risk management, and ethical practices.

- Risk Management: Implement a comprehensive risk management framework that identifies and assesses risks across the organisation. Develop mitigation strategies and controls to address these risks and regularly monitor and report on risk management activities.

- Stakeholder Engagement: Engage with stakeholders to understand their needs, concerns, and expectations. Consider stakeholder perspectives in decision-making processes and establish mechanisms for ongoing dialogue and feedback.

- Transparency and Disclosure: Practice transparency by providing timely, accurate, and comprehensive disclosure of relevant information to stakeholders. This includes financial reporting, non-financial performance, governance practices, and material events.

- Code of Conduct: Develop and enforce a robust code of conduct that outlines expected behavior for employees, executives, and board members. Communicate the code effectively, provide training, and establish reporting mechanisms for potential breaches.

- Whistleblower Protection: Establish a confidential and independent whistleblowing mechanism that allows employees and stakeholders to report potential misconduct or unethical behavior without fear of retaliation. Ensure proper investigation and action on reported concerns.

- Sustainability Initiatives: Integrate sustainability considerations into the company's strategy and operations. Set environmental, social, and governance (ESG) goals, measure and report progress, and actively contribute to sustainable development.

- Corporate Social Responsibility: Embrace corporate citisenship by supporting social causes, engaging in philanthropy, and contributing positively to the communities in which the company operates.

By implementing these practices, organisations can promote responsibility, establish a culture of ethical behavior, and contribute to sustainable and long-term value creation for all stakeholders involved.

Contrasting Corporate Responsibility: Ray, Ephraim, and Billy

Ray Kroc: The Visionary Steward

Ray Kroc, the founder of McDonald's, stands out as a visionary steward of corporate responsibility. His commitment to quality, customer satisfaction, and community engagement became the pillars of McDonald's success. Ray embraced the concept that responsible business practices extend beyond profits. Under his leadership, McDonald's became synonymous with consistency, cleanliness, and community involvement, showcasing a holistic approach to corporate responsibility.

Ephraim Diveroli: The Unethical Entrepreneur

Ephraim Diveroli, as depicted in War Dogs, represents the dark side of entrepreneurial ventures. His pursuit of profit often led him down ethically questionable paths, compromising corporate responsibility. Ephraim's engagement in arms dealing without due diligence, disregard for quality standards, and breaches of legal regulations showcased a blatant lack of responsibility. The consequences of his actions not only affected his company but also had far-reaching implications for stakeholders and the industry.

Billy Beane: Innovation with Integrity

In the world of baseball and business, Billy Beane of Moneyball fame showcases a balance between innovation and integrity. While challenging conventional norms, Billy employed data-driven decision-making to revolutionise the Oakland Athletics. The emphasis on fairness, ethics, and the well-being of players highlighted Billy's commitment to corporate responsibility. His approach demonstrated that responsible business practices can coexist with groundbreaking innovation, setting a positive example for future entrepreneurs.

Corporate Governance: Upholding Responsibility for Long-Term Success

Responsibility should be upheld consistently and at various stages of an organisation's operations. Here are key instances when responsibility should be demonstrated:

- Strategic Planning: Responsibility begins during the strategic planning process. Companies should consider the long-term impact of their decisions on stakeholders, the environment, and society. This includes setting responsible business objectives and aligning them with the company's values and purpose.

- Decision Making: Responsibility should be practiced during all decision-making processes. This includes evaluating options based on ethical considerations, potential risks, and the impact on stakeholders. Responsible decision-making ensures that actions are aligned with the company's values and contribute to sustainable growth.

- Financial Management: Responsibility is crucial in financial management. Companies should establish sound financial practices, accurate reporting, and internal controls to ensure transparency, accountability, and compliance with financial regulations. Responsible financial management protects the interests of shareholders and stakeholders.

- Risk Management: Responsibility should be exercised in identifying, assessing, and managing risks. This includes implementing risk management processes, establishing risk mitigation strategies, and regularly reviewing risk exposures. Responsible risk management safeguards the company's operations and stakeholders from potential harm.

- Stakeholder Engagement: Responsibility extends to engaging with stakeholders throughout the organisation's lifespan. Companies should actively listen to stakeholder concerns, consider their perspectives, and respond transparently and effectively. Engaging stakeholders fosters trust, collaboration, and shared value creation.

- Compliance: Responsibility requires ongoing compliance with laws, regulations, and industry standards. Companies should ensure that their practices, policies, and operations align with legal requirements and ethical principles. Compliance demonstrates a commitment to integrity and responsible business conduct.

- Sustainability Practices: Responsibility encompasses sustainable practices. Companies should integrate environmental, social, and governance (ESG) considerations into their operations. This includes reducing environmental impacts, promoting diversity and inclusion, and supporting the well-being of communities. Responsible sustainability practices contribute to long-term value creation.

- Corporate Reporting: Responsibility is vital in corporate reporting. Companies should provide accurate, transparent, and timely reporting of financial and non-financial information. This includes disclosing material information, risks, and governance practices to enable stakeholders to make informed decisions.

- Corporate Changes: Responsibility should be demonstrated during corporate changes, such as mergers, acquisitions, or restructuring. Companies should consider the impact of these changes on employees, shareholders, and other stakeholders. Responsible management of these changes minimises disruption and ensures fair treatment of all parties involved.

- Ongoing Evaluation: Responsibility is an ongoing commitment that requires regular evaluation and improvement. Companies should periodically assess their corporate governance practices, ethical conduct, and sustainability performance. This allows for continuous enhancement and adaptation to changing circumstances.

By prioritising responsibility throughout these key stages, companies can build trust, foster accountability, and contribute to sustainable and ethical business practices.

Corporate Governance Strategies: Integrating Responsibility

In essence, the core takeaway from the discussion on responsible corporate governance revolves around the imperative for businesses to proactively integrate ESG principles into their operations. Firstly, there's a critical need for environmental consciousness, with an emphasis on adopting sustainable practices and leveraging eco-friendly technologies to minimise carbon footprints. This not only aligns with global environmental goals but also positions companies to navigate potential risks and uncertainties associated with climate change. The focus on environmental sustainability is not merely a moral obligation but a strategic imperative for long-term business resilience.

Secondly, social responsibility plays a pivotal role in shaping a company's corporate governance. By fostering diversity and inclusion, promoting fair labor practices, and actively engaging with local communities, businesses can build a positive and socially responsible identity. Prioritising employee well-being and ethical supply chain practices further strengthens the social fabric of a company, fostering a sense of trust among employees, customers, and the broader community. Socially responsible actions contribute to a positive corporate culture and enhance the overall reputation of the organisation.

Lastly, effective governance is the linchpin that holds together the fabric of responsible corporate conduct. Transparency, accountability, and ethical decision-making are foundational elements of governance structures. Companies need to establish clear lines of authority, diverse boards, and mechanisms for checks and balances. By doing so, businesses can ensure that their operations align with ethical standards, fostering a culture of integrity and trust. The integration of ESG factors into governance isn't just a regulatory compliance; it's a strategic approach that positions businesses for sustained success in a rapidly evolving global landscape. In summary, responsible corporate governance is a holistic commitment encompassing environmental stewardship, social impact, and effective governance structures, ultimately driving long-term value creation and positive societal contributions.

Join the Conversation: Share Your Thoughts on This Article

- No comments yet.

Add Your Comment Now!