SME Corporate Governance Best Practices: How to be accountable

|

Accountability involves implementing mechanisms for monitoring and evaluating performance, such as regular financial reporting, internal and external audits, and robust risk management processes.

Corporate Governance Accountability: Key Strategies for Ethical Leadership

Understanding corporate governance accountability is essential for ethical leadership. Discover the significance of accountability in corporate governance, ensuring transparency, integrity, and stakeholder trust. Learn actionable strategies to foster accountability within your organization, including clear communication channels, effective oversight mechanisms, and robust compliance frameworks. Elevate your leadership by prioritizing accountability, driving sustainable growth, mitigating risks, and enhancing reputation. Explore how embracing accountability can reinforce corporate values, promote responsible decision-making, and ultimately contribute to long-term success in today's dynamic business landscape.

Corporate Governance Accountable Consideration

- Firstly, businesses should establish a robust framework that includes a well-defined organisational structure with clear roles and responsibilities for the board of directors, executives, and other stakeholders. This framework should also encompass ethical guidelines and compliance standards, fostering a culture of integrity and responsibility throughout the organisation. Additionally, businesses must prioritise shareholder rights and engagement, promoting open communication channels and providing shareholders with the necessary information to make informed decisions.

- Secondly, accountability involves implementing mechanisms for monitoring and evaluating performance. This includes regular and accurate financial reporting, internal and external audits, and risk management processes. The board of directors plays a key role in overseeing executive actions and ensuring that the company's strategies align with its mission and values. Moreover, businesses should foster diversity and independence within their boards to avoid conflicts of interest and encourage a broader range of perspectives. By prioritising these aspects, businesses can build trust with stakeholders, enhance their reputation, and contribute to long-term sustainability and success.

How to be accountable

Written by: Malose Makgeta

MBA with 20+ years experience in SME development and funding. LinkedIn Profile

Corporate Governance Accountable - Entrepreneurship Lessons from Movies McDonald's, Oakland A's and War Dogs

- The Founder (McDonald's): The first restaurant opened by the McDonald brothers was not initially successful, leading them to redesign it into what we now recognise as McDonald's. Ray Kroc, who joined later, hadn't perfected the initial business model, nor did he have a detailed business plan. Both the McDonald brothers and Ray faced near failure because they lacked a business plan. Fortunately, they had the resources to delve deep into the business without one. If you have the resources, you can start without a business plan; otherwise, a business plan is critical.

- War Dogs (AEY): AEY and Efraim exhibit a lack of accountability in their actions as they navigate the world of international arms dealing. Driven by the pursuit of financial success and exploiting loopholes in government contracts, they engage in dubious practices and compromises, neglecting ethical considerations. Their involvement in supplying arms to conflict zones, disregard for legal and moral boundaries, and overall pursuit of profit at any cost underscore a lack of accountability to broader societal and ethical norms. The consequences of their actions, both legal and personal, highlight the absence of a responsible and accountable approach in their entrepreneurial endeavors, ultimately leading to severe repercussions for themselves and those around them.

- Moneyball (Oakland A's): Billy Beane built a successful team without a traditional business plan; instead, he made decisions as he went along and eventually stumbled upon Peter Brand, who believed in the predictive analytics system. This approach led the Oakland A's to a 20-game winning streak, breaking records in American baseball history.

- Explore further insights on business plan development lessons derived from our case study movies: McDonald's, Oakland A's and War Dogs by clicking here.

CONTEXT

How to improve your corporate governance is about Identifying and mitigating numerous risks associated with a project. Managers who anticipate and plan for common business risks are more likely to avoid pitfalls. This skills programme covers the King IV in the context of SMMEs, as well as how to improve corporate governance in terms of defining roles, reporting and disclosure, corporate social responsibility, and risk governance. This skills programme provides entrepreneurs and business managers with a platform and tools for identifying and managing business risks.

Description

Accountability is about responsibility of the directors. The role of shareholders in governance is to appoint directors and auditors and to ensure that an appropriate governance structure is in place.

Purpose

Be able to explain the purpose of a businesss activities as well as the outcomes of its actions. It and business leadership are responsible for evaluating a businesss capacity, potential, and performance. It must communicate important issues to shareholders.

Rational

Accountability eliminates the time and effort spent on distracting and annoying activities, as well as other unproductive activities and behaviour. People in business organisations must be held accountable for their actions, and this requires effective teaching of the value of work. If it is implemented, it has the potential to improve team members skills and confidence.

Key Lessons

Click here and draft your business plan in minutes

To request tailored accredited training and enterprise development services, contact us at businessplan@superdealmaker.com.

Get List for Funding Opportunities in Minutes, Click Here

To request tailored investment banking services, contact us at businessplan@superdealmaker.com.

The Downfall: AEY and Ephraim's Lack of Accountability in War Dogs

Unraveling the Corporate Governance Quandary

In the gripping tale of War Dogs, the narrative takes a somber turn as we delve into the realm of accountability, or rather, the lack thereof, in AEY's corporate governance. Ephraim Diveroli's charismatic leadership, coupled with his audacious business tactics, eventually led to a conspicuous absence of accountability within the company. This absence manifested in a myriad of ways, from financial irregularities to the neglect of ethical considerations in their arms dealing endeavors.

Ethical Quagmire: The Impact of Accountability Lapses

The absence of a robust accountability framework had profound implications for AEY. Ephraim's cavalier approach to compliance and financial oversight resulted in legal entanglements and tarnished the company's reputation. The impact extended beyond the bottom line, affecting relationships with both clients and government entities. The ethical quagmire they found themselves in showcased the dire consequences of overlooking accountability in the high-stakes world of arms trading.

Lessons Learned: The Importance of Corporate Accountability

As we dissect the unraveling of AEY, entrepreneurs and business leaders can draw crucial lessons. The lack of accountability, though momentarily advantageous, ultimately led to a downfall that outweighed any short-term gains. It underscores the importance of instilling a culture of responsibility, transparency, and adherence to ethical standards within a business. In the corporate landscape, accountability is not a mere formality but a shield against the pitfalls that can dismantle even the most audacious ventures.

McDonald's: The Double-Edged Sword of Financial Accountability

McDonald's, under Ray Kroc's financial stewardship, exemplifies a dual narrative of accountability. On one hand, Kroc's strategic acumen and relentless pursuit of growth showcase a founder deeply invested in the financial success of the franchise. However, this accountability takes a darker turn as ethical compromises are made for financial gains. The impact of financial success is tainted by a shadow on the ethical integrity of the brand, portraying a complex balance between financial ambition and ethical responsibility.

Moneyball: Billy Beane's Data-Driven Accountability

Moneyball introduces a different facet of accountability through Billy Beane's data-driven decision-making. Beane's accountability is deeply rooted in statistical analysis, challenging conventional norms in baseball. His approach highlights a commitment to results-driven accountability, where success is measured not by tradition but by quantifiable outcomes. While Beane's methods are revolutionary, the film underscores the challenges and resistance faced when accountability is redefined based on data rather than tradition.

War Dogs: Ethical Accountability in the Arms Trade

War Dogs introduces a unique perspective on accountability within the context of the arms trade. Ephraim Diveroli and David Packouz navigate the ethical minefield of government contracting. The film portrays a stark contrast where financial gains are achieved at the expense of ethical standards. The impact of their actions extends beyond financial success, illustrating the consequences of accountability when it collides with the moral complexities of dealing in the arms industry.

What is Accountability

Accountability is a cornerstone in the realm of corporate governance, embodying the responsibility and answerability that individuals and entities hold for their actions and decisions.

Accountability is the practice of being held to a high standard of excellence. It is the idea that an individual is responsible for their actions and that if that individual chooses unfavorable actions, they will face consequences. Accountability seeks to promote a high level of work, honesty, dependability, and trust from those around you.

According to management coaches, workplace accountability extends beyond assigning each employee a task to complete as part of a project. It also entails holding each person accountable for the success or failure of their individual contribution to the overall project. In other words, it's all about taking responsibility for one's own success—or failure.

Accountability has evolved into a key concept in corporate finance. It is especially relevant to the accounting practices that a company uses when preparing financial reports for shareholders and the government. Without checks and balances, as well as consequences for wrongdoing, a company cannot maintain the trust of its customers, regulators, or markets.

The Essence of Accountability

At its core, accountability ensures transparency, fairness, and ethical behavior within an organisation. It goes beyond mere compliance with rules and regulations, delving into the commitment of individuals to act responsibly in the best interest of the company and its stakeholders.

In the context of corporate governance, accountability is not confined to financial matters but extends to strategic decision-making, risk management, and the overall well-being of the organisation. It involves being answerable for one's actions, whether they lead to success or failure.

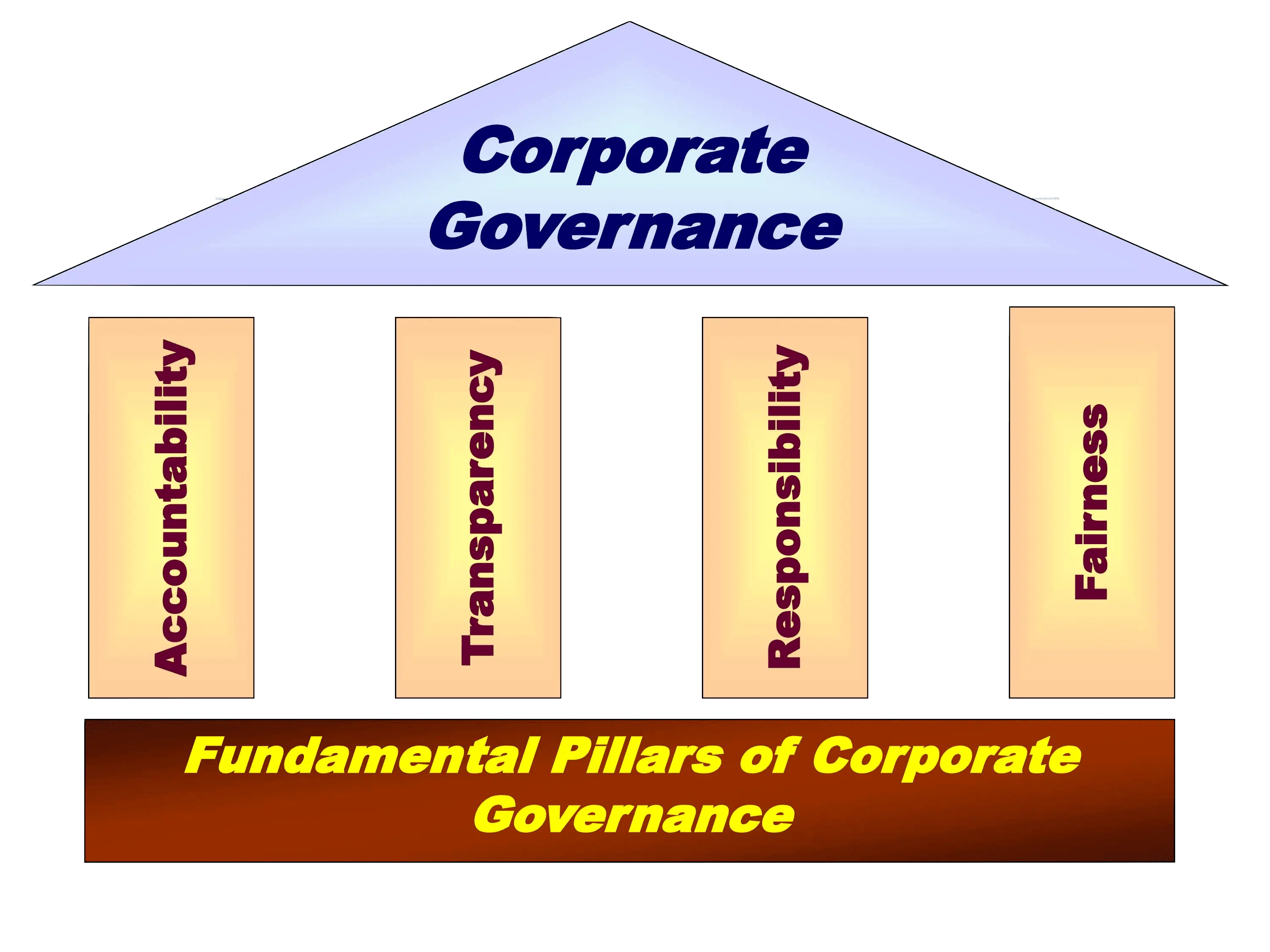

Key Components of Accountability

- Transparency: Accountability requires openness in communication and decision-making processes, ensuring that stakeholders are informed about the organisation's activities.

- Responsibility: Individuals within the corporate structure must acknowledge and accept the consequences of their actions, whether positive or negative, and take steps to rectify any adverse outcomes.

- Ethical Decision-Making: Accountability demands that decisions align with ethical standards and the best interests of the company and its stakeholders, even in challenging situations.

By fostering a culture of accountability, businesses contribute to their long-term success and sustainability. It builds trust among stakeholders, enhances corporate reputation, and fosters an environment where innovation and responsible risk-taking can flourish.

Examples of Poor Accountability

Poor accountability within the realm of corporate governance can have far-reaching consequences, impacting the overall health and sustainability of a business. Let's explore some examples that illustrate the pitfalls of insufficient accountability.

- Lack of Transparency One common example of poor accountability is the absence of transparency in financial reporting. When key financial information is concealed or manipulated, stakeholders are left in the dark, eroding trust and potentially leading to legal repercussions.

- Shifting Blame Without Resolution In instances where accountability is lacking, individuals may engage in a culture of blame-shifting rather than taking responsibility for their actions. This behavior not only hampers problem resolution but also creates a toxic work environment.

- Unethical Decision-Making Poor accountability can manifest in unethical decision-making, where leaders prioritise personal gain over the best interests of the company and its stakeholders. This can lead to financial scandals, legal issues, and reputational damage.

- Ignoring Stakeholder Concerns A lack of accountability may be evident when businesses disregard the concerns of their stakeholders, such as employees, customers, or investors. Failing to address valid concerns can lead to disengagement, employee turnover, and a loss of customer trust.

In summary, poor accountability can manifest in various ways, each detrimental to the health and reputation of a business. Recognising and rectifying these shortcomings is crucial for fostering a culture of responsibility and ensuring the long-term success of the organisation.

Billy's Gambit: The Initial Stumble

Hook: When the Slick Game Plan Hit a Snag

Enter Billy Beane, armed with a bold strategy to revolutionise baseball through data-driven decision-making. However, even the best-laid plans can go awry. Picture the scene: Billy's initial failure lay in the overreliance on statistics without factoring in the human element of the game. In his pursuit of a winning formula, he momentarily overlooked the intangibles that make a team click—chemistry, motivation, and the unpredictability of human performance.

Impact: Ripples of Discontent and Disarray

The repercussions of Billy's oversight were felt not just in the game statistics but within the team dynamics. Players, accustomed to the traditional scouting system, felt marginalized. This initial stumble led to a rocky start, with dissent brewing in the locker room. The impact rippled beyond the numbers, creating a rift in the team's morale and camaraderie.

Accountability: Owning Up to the Misstep

Billy's accountability shone through in the aftermath of the initial failure. Instead of deflecting blame, he recognised the shortcomings of his strategy. This self-awareness became a turning point, prompting a recalibration of the approach. It's a lesson in leadership—acknowledging mistakes, learning from them, and adapting strategies for long-term success.

Lessons Learned: The Journey to Redemption

So, entrepreneurs, take a page from Billy's playbook. In the pursuit of innovation, be mindful of the human factor. Numbers tell a story, but they aren't the sole narrative. Embrace a holistic approach, combining data insights with an understanding of the human elements at play. It's not just about the wins and losses on paper; it's about fostering a winning culture within your team.

Why Accountability Important

Accountability plays a pivotal role in the success and sustainability of businesses, ensuring transparency, ethical conduct, and the overall health of corporate operations.

Upholding Transparency and Trust

One of the primary reasons accountability is essential is its role in maintaining transparency within an organisation. When individuals and entities are accountable for their actions, decisions, and performance, stakeholders gain insight into the inner workings of the business. This transparency builds trust among shareholders, customers, and partners, fostering a positive reputation for the company.

Driving Ethical Conduct

Accountability serves as a cornerstone for ethical decision-making. In a business context, this means that individuals are held responsible for aligning their actions with established ethical standards. By doing so, businesses mitigate the risk of unethical behavior, ensuring that corporate activities are conducted with integrity and in the best interest of all stakeholders.

Enhancing Performance and Innovation

Accountability fosters a culture of responsibility, motivating employees to perform at their best. When individuals know that their actions have consequences, positive or negative, they are more likely to take ownership of their tasks and contribute to the overall success of the organisation. Moreover, a sense of accountability encourages innovation and responsible risk-taking, driving the business forward in a competitive landscape.

In conclusion, accountability is not just a buzzword; it is a fundamental aspect of corporate governance that shapes the ethical character and operational efficiency of a business. Embracing accountability contributes to a sustainable and trusted business environment, laying the groundwork for long-term success.

Benefits of Accountability

Accountability will differ from one company to the next. However, if a company is able to properly implement accountability practices, it can provide the following overarching benefits:

- Accountability leads to operational excellence. When employees understand that their work is being scrutinised and will be evaluated, they are more likely to exert greater effort because they understand that what they do is important. This is especially true when strong accountability is rewarded with raises, promotions, and public recognition.

- Accountability safeguards company resources. Accountability is more than just doing your job; it is the practice of being truthful and accountable for your actions in all circumstances. Accountability holds employees to a standard that company resources must be respected, and employees are less likely to mistreat company assets because they understand there will be consequences for their actions.

- Accountability yields more accurate results. Companies that have an accountability standard will have acceptable deviation boundaries. A company, for example, may allow for a certain dollar amount of financial misstatement due to immateriality. If a company holds itself o a low threshold of materiality, it will not tolerate larger errors, unexplainable variances, or reporting delays.

- Accountability builds external investor trust. The prospect of financial success can only drive an investor's confidence in a company so far. Investors must believe that a company is well-run, honest, competent, and resourceful. If a company can demonstrate accountability, it will be viewed favorably, especially when compared to an untrustworthy adversary.

Ray's Financial Tightrope: A Founder's Accountability

In the tumultuous world of McDonald's ascent, Ray Kroc emerges as a founder deeply entwined with the financial performance of the franchise. His accountability stems not only from the ambition to turn a profit but also from a relentless pursuit of growth and dominance. The movie portrays Ray's financial stewardship with a blend of admiration and critique, showcasing both the brilliance and pitfalls of his approach.

Financial Mastery: Ray's Strategic Acumen

Ray Kroc, played by Michael Keaton, is depicted as a financial maestro, orchestrating the franchise's financial symphony with finesse. His ability to navigate the complexities of franchising, real estate, and operational costs showcases a strategic acumen that is both commendable and awe-inspiring. Ray's accountability for financial performance is driven by a desire for the relentless expansion of the McDonald's empire, turning it into a global force.

The Double-Edged Sword: Ethical Quandaries and Financial Gains

However, Ray's accountability is not without its controversies. The movie doesn't shy away from portraying instances where financial pursuits lead to ethical quandaries. The decision to cut corners and compromise on the quality of ingredients for higher profit margins highlights a darker side of Ray's financial accountability. The impact, though financially lucrative, casts a shadow on the ethical integrity of the brand.

Legacy of Ambition: Ray's Impact on McDonald's Financial Landscape

Ray's unyielding accountability for financial performance leaves an indelible mark on the McDonald's legacy. The franchise's global expansion and financial success are testaments to his audacious vision. However, the movie also serves as a cautionary tale, reminding us that the pursuit of financial glory can sometimes come at the cost of ethical compromise. Ray's impact on McDonald's financial landscape is a complex tapestry, woven with both triumphs and ethical dilemmas.

Importance of Implementing Accountability

Implementing accountability measures is crucial for several reasons, contributing to the overall health and sustainability of a business:

Transparency and Trust

Regular financial reporting and audits foster transparency. Stakeholders, including investors and the public, can make informed decisions, leading to increased trust in the company's operations and financial health.

Credibility and Compliance

External audits and adherence to industry standards enhance the credibility of a company's financial information. This, in turn, ensures compliance with regulatory requirements, reducing the risk of legal issues and financial penalties.

Risk Mitigation

A robust risk management system helps identify and address potential challenges before they escalate. This proactive approach protects the company against unforeseen risks, contributing to long-term sustainability.

Shareholder Protection:

By prioritising accountability, businesses demonstrate a commitment to protecting shareholder interests. This is essential for maintaining investor confidence and attracting potential investors.

Ethical Corporate Culture

Promoting an ethical corporate culture instills a sense of responsibility in employees. This not only helps in preventing unethical practices but also contributes to the overall reputation of the company.

In summary, the implementation of accountability measures is essential for building trust, maintaining compliance, mitigating risks, protecting shareholder interests, and fostering an ethical corporate culture. These elements collectively contribute to the long-term success and sustainability of a business.

Practicing Accountability

Accountability is not just an ideal; it's a set of practices that businesses can adopt to ensure responsible conduct and ethical decision-making.

Establishing Clear Responsibilities

One way businesses can demonstrate accountability is by clearly defining roles and responsibilities within the organisation. This includes specifying the duties of each employee, manager, and executive, ensuring that everyone understands their contributions to the company's goals and objectives.

Transparent Communication

Open and transparent communication is crucial for fostering accountability. Businesses should create channels for employees to express concerns, report issues, and share feedback. This not only builds trust but also allows for timely resolution of problems, preventing them from escalating.

Adhering to Ethical Standards

Businesses showcase accountability by prioritising and upholding ethical standards. This involves making decisions that align with moral principles, legal requirements, and the best interests of stakeholders. Companies should establish a code of ethics and ensure that employees are well-versed in these guidelines.

Monitoring and Evaluation

Regular monitoring and evaluation of business processes contribute to accountability. This includes performance reviews, audits, and assessments of compliance with regulatory requirements. By regularly assessing operations, businesses can identify areas for improvement and take corrective action when necessary.

In essence, accountability in business is a proactive commitment to responsibility, transparency, and ethical behavior. By implementing these practices, businesses not only fulfill their obligations to stakeholders but also create a culture of integrity that contributes to long-term success.

How to Promote Accountability in Four Steps

Setting up accountability is essential if you want to bring about change, influence performance, or motivate an action or behavior. Higher performance, a stronger commitment to the job, and more motivation all result from greater accountability. Consider accountability as the course of action you choose depending on whether someone exceeds, satisfies, or fails to satisfy expectations. This establishes guidelines for accountability.

Benchmarking performance against clearly defined objectives is necessary for accountability. Improving state ownership is typically the very first step towards better accountability because it is frequently characterised by nebulous, complex, or contradictory objectives. This chapter offers instructions on how to formulate and convey precise goals at all pertinent levels. Additionally, it offers advice on how to create practical performance indicators for comparing performance to these goals.

1) Define the behavior or outcome that is needed.

- What is the task, goal, or behavior and why is it important?

- What does success look like?

- When does it need to get done?

2) Communicate. Expectations can be discussed during a staff or faculty meeting, in an email, or in a one-on-one setting.

3) Assess. Choose the (positive or negative) outcome when the expectation is met or not. The result can have a variety of effects, such as career impact, social pressure because others will be able to tell if the expectation was met, or praise or criticism.

4) Follow through.The accountability model's follow-through step is perhaps its most important—and occasionally its most challenging—step. This step entails taking action to address the behavior or outcome (positively or negatively). Lack of action can equate to a lack of accountability.

Implementing Accountability

Accountability is a multifaceted approach that involves various mechanisms to ensure transparency, responsibility, and ethical conduct. Here's a breakdown of how to implement accountability:

1. Financial Reporting

Regular and transparent financial reporting is a cornerstone of accountability. Implement a robust system for preparing and disseminating financial reports that provide a comprehensive overview of the company's financial position. This ensures that stakeholders, including investors, regulators, and the public, have access to accurate and timely information.

2. Internal and External Audits

Implement a comprehensive audit system, both internal and external. Internal audits serve as a proactive measure to identify and address potential issues within the company's internal controls and processes. External audits, conducted by independent third parties, provide an objective evaluation of financial statements, further ensuring credibility and adherence to industry standards.

3. Robust Risk Management

Develop and implement a robust risk management system. Identify, assess, and mitigate risks that could impact the company's operations and objectives. By addressing potential challenges proactively, businesses demonstrate a commitment to long-term sustainability and the protection of shareholder interests.

4. Promoting Ethical Culture

Instill a culture of responsibility and ethics within the organisation. This involves promoting ethical conduct at all levels and ensuring that employees understand and adhere to ethical standards. Training programs and clear communication of the company's values contribute to fostering a culture of accountability.

By integrating these measures, businesses can establish a robust framework for accountability, building trust among stakeholders and contributing to long-term success.

Accountability Key Takeaways:

The essence of accountability lies in the implementation of rigorous mechanisms designed to monitor and evaluate performance. Regular financial reporting stands out as a fundamental component of this accountability framework, ensuring that a company's financial health is transparently communicated to stakeholders. Through these reports, businesses provide a comprehensive overview of their financial position, enabling investors, regulators, and the public to make informed decisions.

Internal and external audits further fortify the accountability structure by independently assessing the company's internal controls, risk management processes, and financial statements. Internal audits serve as a proactive measure, identifying potential issues before they escalate, while external audits conducted by independent third parties provide an objective and unbiased evaluation. These processes not only enhance the credibility of a company's financial information but also contribute to maintaining trust among stakeholders, as they demonstrate a commitment to transparency and adherence to industry standards.

In tandem with financial reporting and audits, a robust risk management system is crucial for accountability. This involves identifying, assessing, and mitigating risks that could impact the company's operations and objectives. By proactively addressing potential challenges, businesses demonstrate their commitment to long-term sustainability and the protection of shareholder interests. The integration of these accountability measures not only safeguards the company against unforeseen risks but also fosters a culture of responsibility, reinforcing the foundations of ethical corporate governance.

Join the Conversation: Share Your Thoughts on This Article

- No comments yet.

Add Your Comment Now!