SME Corporate Governance Best Practices: How to manage risk

|

Enhance your business's longevity and adaptability by implementing a comprehensive risk management strategy. Identify potential internal and external risks through thorough assessments covering financial, operational, and strategic facets. Establish robust risk management frameworks, including preventive measures like strong internal controls and contingency plans.

Corporate Governance: Managing Risk for Sustainable Growth

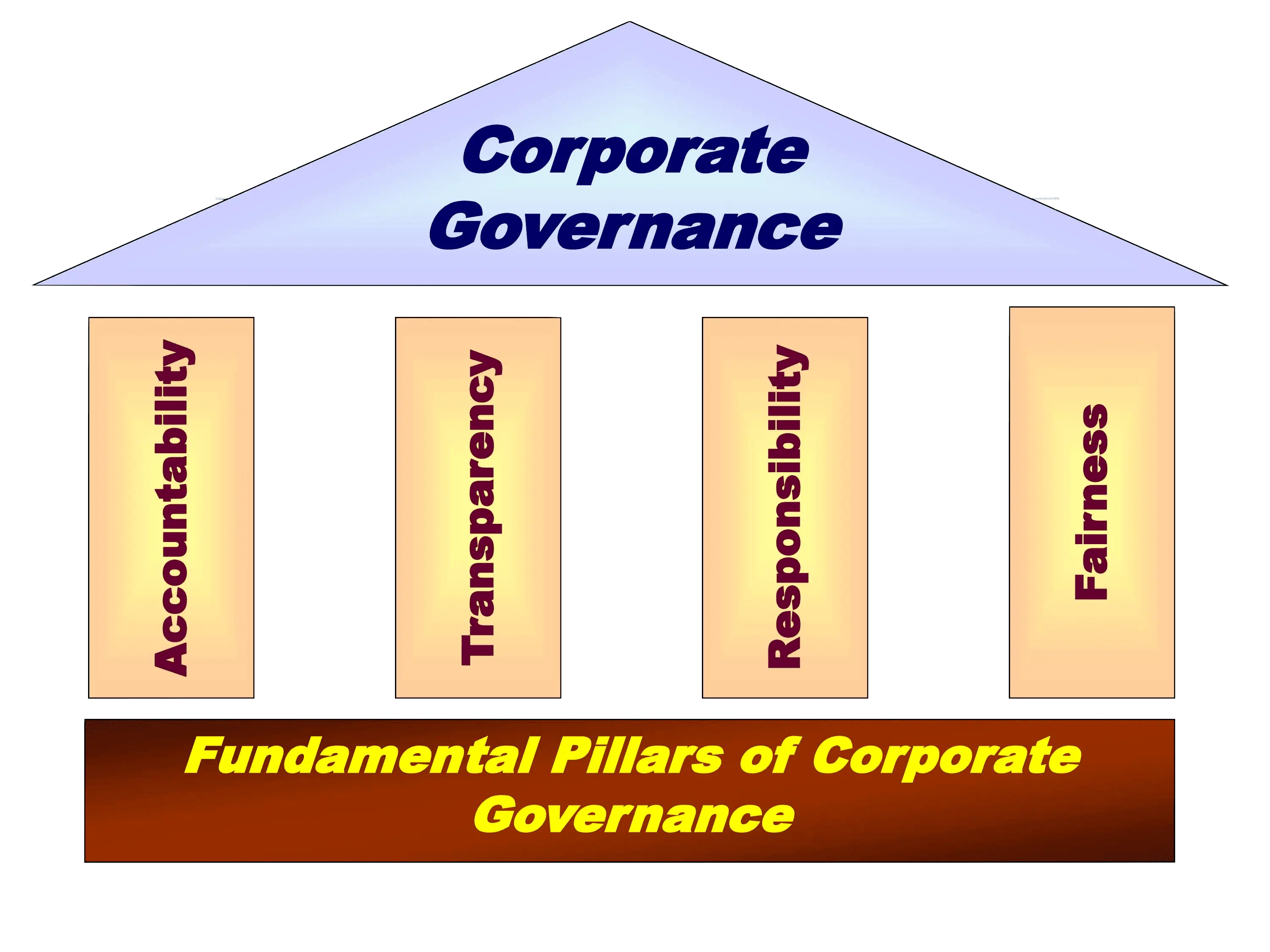

Explore the pivotal role of corporate governance in risk management and sustainable growth. Understanding corporate governance empowers organizations to establish robust frameworks for decision-making, accountability, and transparency. Learn how to navigate regulatory compliance, mitigate risks effectively, and foster stakeholder trust. Discover essential strategies for implementing best practices in corporate governance, ensuring resilience and long-term viability in today's dynamic business landscape. Gain insights into risk assessment, mitigation techniques, and the alignment of risk management with strategic objectives. Elevate your business performance and safeguard its reputation by mastering the principles of corporate governance and effective risk management.

Understanding Corporate Governance and Effective Risk Management

- Businesses should adopt a comprehensive approach to risk management, considering both internal and external factors that could impact their operations. Firstly, they should conduct thorough risk assessments to identify potential risks and vulnerabilities across various aspects of the business, including financial, operational, and strategic areas. This involves analysing market trends, regulatory changes, and technological advancements that may affect the industry. Additionally, businesses should assess internal factors such as organisational structure, employee capabilities, and information security protocols. By understanding these risks, organisations can develop strategies to mitigate them effectively.

- Secondly, businesses must establish robust risk management processes and frameworks. This includes implementing preventive measures, such as implementing strong internal controls, setting up contingency plans, and investing in insurance coverage. Furthermore, fostering a risk-aware culture within the organisation is crucial, encouraging employees at all levels to be vigilant and report potential risks promptly. Regular monitoring and reassessment of risks are also essential as the business environment evolves. By integrating risk management into decision-making processes, businesses can enhance their resilience and ability to adapt to unforeseen challenges, ultimately safeguarding their long-term success.

How to manage risk

Written by: Malose Makgeta

MBA with 20+ years experience in SME development and funding. LinkedIn Profile

Navigating Risk in Business Environment: McDonald's, Oakland A's and War Dogs

- The Founder (McDonald's): The success of McDonald's can be attributed to the strategic application of effective risk management principles by the McDonald brothers, Richard and Maurice, and later by Ray Kroc. The initial innovation of the Speedee Service System, which streamlined and standardized operations, can be seen as a proactive risk management strategy aimed at ensuring operational efficiency. The brothers focused on reducing potential risks in the food industry, such as inconsistent quality and slow service. Ray Kroc, recognising the scalability potential of the McDonald's model, applied risk management by expanding the franchise system, allowing for geographic diversification and reducing dependence on a single location. Additionally, the emphasis on maintaining a standardized menu and consistent quality across franchises mitigated risks associated with varying consumer expectations. Together, the McDonald brothers and Ray Kroc's approach to risk management played a pivotal role in establishing McDonald's as a global brand with enduring success.

- War Dogs (AEY): AEY managed risk through a combination of strategic calculation and opportunism. The company capitalised on a government initiative that allowed small businesses to bid on military contracts, presenting a low-entry barrier and reducing financial risk. Additionally, AEY navigated the complexities of the international arms trade by leveraging Efraim's knowledge and connections. Their risk management also involved forming partnerships to fulfill contracts, spreading the operational burden. However, as the duo delved deeper into the world of arms dealing, they faced escalating legal and ethical risks, leading to a critical examination of their choices and the potential consequences of their actions. Overall, AEY's risk management strategy was a blend of seising opportunities with low entry barriers and adapting to the challenges of an inherently risky industry.

- Moneyball (Oakland A's): The Oakland Athletics applied a unique approach to risk management in the realm of professional baseball. Facing financial constraints compared to larger-market teams, Beane and the A's strategically analyzed player performance data to identify undervalued assets in the market. This data-driven approach can be seen as a proactive risk management strategy aimed at maximising the team's efficiency within budgetary constraints. By challenging traditional scouting methods and embracing sabermetrics, the A's sought to reduce the inherent risks associated with player recruitment, focusing on statistical indicators of performance rather than conventional subjective assessments. The emphasis on exploiting market inefficiencies and undervalued players demonstrated an innovative risk mitigation strategy that ultimately allowed the small-market A's to compete with more resource-rich teams and achieve notable success in the competitive landscape of Major League Baseball.

- Explore further insights on business plan development lessons derived from our case study movies: McDonald's, Oakland A's and War Dogs by clicking here.

CONTEXT

How to improve your corporate governance is about Identifying and mitigating numerous risks associated with a project. Managers who anticipate and plan for common business risks are more likely to avoid pitfalls. This skills programme covers the King IV in the context of SMMEs, as well as how to improve corporate governance in terms of defining roles, reporting and disclosure, corporate social responsibility, and risk governance. This skills programme provides entrepreneurs and business managers with a platform and tools for identifying and managing business risks.

Description

Risk management is about the process of identifying potential business hazards and taking steps to reduce

Purpose

Be able to identify and control risks of all types. To manage them, they must act on those recommendations. They must notify all parties involved about the existence and status of risks.

Rational

Risk management is essential for good corporate governance because it bridges the gap between strategic initiatives and day-to-day operational results.

Key Lessons

Click here and draft your business plan in minutes

To request tailored accredited training and enterprise development services, contact us at businessplan@superdealmaker.com.

Get List for Funding Opportunities in Minutes, Click Here

To request tailored investment banking services, contact us at businessplan@superdealmaker.com.

Integrating Risk Management into Corporate Governance: Contrasting Ray, Ephraim, and Billy

Ray Kroc: The Franchise Pioneer

Ray Kroc, portrayed by Michael Keaton in "The Founder," tackled risk by embracing the franchise model for McDonald's. His approach was methodical, emphasising standardisation and consistency. Ray believed in spreading the risk among franchisees, creating a vast network of entrepreneurs who shared the burden of success and failure. The calculated risk for Ray was in the expansion, and the franchise model allowed him to scale without bearing the full weight of individual store performance.

Ephraim Diveroli: The Arms Dealer Maverick

In "War Dogs," Jonah Hill's character, Ephraim Diveroli, approaches risk with audacity and a willingness to navigate the unpredictable arms market. Ephraim's high-risk strategy involves exploiting loopholes and pursuing lucrative government contracts. However, his cavalier attitude toward legality and ethics introduces a different set of risks. The film illustrates how Ephraim's risk appetite, while initially rewarding, eventually leads to legal troubles and jeopardises the sustainability of his arms dealing venture.

Billy Beane: The Data-Driven Baseball Maestro

In "Moneyball," Brad Pitt's portrayal of Billy Beane showcases a unique approach to managing risk in baseball. Billy relies on statistical analysis and data-driven decision-making to challenge conventional scouting methods. His risk lies in defying tradition and trusting untested methodologies. While this approach revolutionises the game, it also invites skepticism and resistance from traditionalists. Billy's risk management involves navigating the tension between data-driven innovation and the resistance to change deeply ingrained in baseball culture.

What is Risk Management: Understanding Corporate Governance and Effective Risk Management

Risk management refers to the systematic process of identifying, assessing, and mitigating risks that may impact an organisation's objectives and operations. It involves implementing strategies, policies, and controls to effectively manage risks and optimise opportunities while ensuring compliance with laws, regulations, and ethical standards.

The key elements of risk management include:

- Risk Identification: Identifying and understanding the potential risks that the organisation may face. This includes internal risks (such as operational, financial, and human resources risks) and external risks (such as market fluctuations, regulatory changes, and technological disruptions).

- Risk Assessment: Assessing the likelihood and potential impact of identified risks. This involves analysing the probability of risks occurring and evaluating their potential consequences on the organisation's objectives, stakeholders, and reputation.

- Risk Mitigation: Developing and implementing strategies to manage and mitigate identified risks. This may involve establishing internal controls, policies, and procedures to minimise the likelihood and impact of risks. It also includes developing contingency plans to respond effectively if risks materialise.

- Monitoring and Review: Regularly monitoring and reviewing the effectiveness of risk management measures. This ensures that risk mitigation strategies are working as intended and allows for timely adjustments or enhancements as new risks emerge or existing risks evolve.

- Reporting and Communication: Reporting on risk management activities and outcomes to key stakeholders. This includes providing accurate and timely information about the organisation's risk profile, risk appetite, and risk management strategies. Effective communication ensures transparency and helps stakeholders make informed decisions.

- Integration with Governance: Integrating risk management into the organisation's governance framework. This involves establishing clear roles and responsibilities for risk oversight, ensuring board involvement in risk management activities, and aligning risk management with the organisation's strategic objectives.

- Continuous Improvement: Continuously improving the organisation's risk management capabilities. This includes learning from past experiences, benchmarking against industry best practices, and fostering a culture of risk awareness and responsiveness throughout the organisation.

Effective risk management enables organisations to proactively identify and address potential threats and opportunities. It helps safeguard the organisation's financial stability, reputation, and long-term sustainability. By managing risks effectively, organisations can make informed decisions, allocate resources efficiently, and enhance stakeholder confidence.

Risk Management Objectives

- Continuity of operations and operational effectiveness - Unexpected operational risks can arise at any time, no matter how well you believe your company has been prepared. Threats can take the form of anything from a new cyberattack to a supplier or service provider who is suddenly unable to meet your company's needs to a catastrophic piece of equipment failing. A well-established risk management process and plan enables you to ensure internal controls to prevent fraud.

- Asset Protection for Your Company - It is critical to protect your company's assets, whether they are physical items, materials, or data. According to a new IBM study, mega-sized data breaches cost businesses in the United States $3.86 million on average, with over 8.5 billion records stolen between April 2019 and 2020. As a result, developing a comprehensive and workable risk management plan is critical from the standpoint of commercial insurance.

- Customer Satisfaction and Loyalty - Customers will feel more at ease doing business with you if they are familiar with your logo, brand, digital presence, and reputation. Furthermore, customers will feel more at ease doing business with you if you have a solid risk management plan in place and use it. By taking preventative measures, you can keep your company's name and reputation intact.

- Realising Benefits and Achieving Goals - Effective risk management is essential for completing projects on time and meeting their objectives. Implementing efficient procedures for identifying, assessing, and managing risks can help your company eliminate low-return projects and activities more quickly. It increases the likelihood that your project portfolio and overall business performance will meet or exceed your expectations, and that you will realise the anticipated benefits.

- Profitability - The primary goal of most businesses is to maintain a positive profit margin. Financial losses can be enormous following a breach, and dealing with the aftermath can sometimes necessitate spending countless hours on end in tedious meetings with legal and insurance representatives. Profitability requires careful management of market, credit, operational, and reputational risks.

Risk Management Strategies

Factors such as company type, structure, complexity, resource availability, and team talents collectively influence the selection of the most suitable entity or function responsible for identifying, appraising, and implementing a risk management strategy. The task of formulating strategies to address threats may fall upon individuals from the risk management team, audit team, project manager, risk expert, or even an external consultant.

Four primary risk management strategies are available for consideration:

- Risk Acceptance - This strategy, while having no impact on the risk's effects, is still a viable option. It is commonly chosen when the costs of alternative risk management approaches, such as risk avoidance or risk limitation, outweigh the cost of the risk itself. Companies may opt for risk acceptance if they do not want to allocate significant resources to prevent unlikely risks.

- Risk Transference - Risk transference involves shifting risk to a willing third party. Businesses often outsource specific operations, such as customer service or payroll services, as a form of risk transference. This can be advantageous if the transferred risk is not a core competency and allows the company to focus on its primary strengths.

- Risk Avoidance - In contrast to risk acceptance, risk avoidance involves actions that prevent any exposure to the risk. It's important to note that risk avoidance is typically the most expensive risk mitigation strategy.

- Risk Limitation - A commonly employed risk management strategy is risk limitation. This strategy involves taking actions to restrict a company's exposure. It can be seen as a blend of risk acceptance and risk avoidance, or a compromise between the two. For example, a company accepting the possibility of a disk drive failure and avoiding prolonged downtime by maintaining backups illustrates risk limitation.

The chosen strategy will determine whether an organisation can effectively manage each risk or face potentially disastrous consequences.

Different risk management strategies serve different purposes and provide various benefits:

- Business Experiments - Utilising this method allows testing various responses to hazards by playing out "what-if" scenarios. Many departments within an organisation, including IT and marketing, have specialists familiar with conducting business experiments. The finance department also runs tests to evaluate ROI and other financial metrics.

- Theory Validation - Questionnaires and group surveys are employed in theory validation strategies to elicit input based on experience. To reduce the risks associated with developing and releasing a new product or service, it is prudent to solicit timely and appropriate feedback from the target audience.

- Development of a Minimum Viable Product - To minimise risk, businesses should develop a "minimum viable product" (MVP) that includes the software's most important functions and components. It helps reduce costs, keep projects on track, and accelerate time to market.

- Identifying and Isolating Risks - IT departments are accustomed to enlisting outside help to identify and correct any security flaws or inefficient procedures that could expose the network to attack. This proactive approach detects potential security threats before an incident occurs, rather than reacting to a malicious and costly intrusion.

- Creating Buffers - Project managers understand the importance of having a safety net in place, whether it's an audit or a piece of technology. Buffers, which keep projects within their specified boundaries, reduce risks. Funding, materials, or time can all be used as buffers depending on the project. The goal is to eliminate potential risks introduced by unexpected events.

- Data Analysis - Risk assessment and management necessitate extensive data collection and analysis. Qualitative risk analysis is one technique that helps spot trouble spots in a project. A thorough qualitative risk analysis is required to identify and rank risks and develop mitigation, monitoring, and reevaluation plans.

- Risk-Reward Analysis - Weighing an endeavor's potential benefits and drawbacks before committing time and money is an excellent risk strategy for businesses and project teams to make informed decisions. It's not just about the potential gains and losses of investing in opportunities; it's also about the cost of passing up opportunities.

- Lessons Learned - Every endeavor and project your company undertakes, whether successful or not, will inevitably provide insight. Lessons learned are a powerful resource for lowering project and endeavor risks in the future, but only if teams take the time to record their findings, analyze them, and devise a strategy for moving forward.

- Contingency Planning - Although it is always preferable to be prepared, having a solid plan in place is not always sufficient. Businesses should be prepared for a variety of possible outcomes, depending on the circumstances. The goal of contingency planning is to prepare for the possibility that something will go wrong and to have a plan in place to deal with the specific risks that you anticipate will derail your original plan.

- Leveraging Best Practices - While the specifics of what constitutes best practices vary from industry to industry and project to project, it is widely accepted that adopting such standards saves businesses time and money. This lowers long-term risks.

Positive Risk Management Strategies

- Exploit - Exploitation increases the likelihood of a positive risk occurring, resulting in an opportunity. Adequate and efficient resources are allocated to capitalize on this opportunity, reducing the uncertainty associated with it.

- Share - When the project team is unable to fully capitalize on the opportunity, assistance from another company may be sought. The expertise of another company is used to maximise the opportunity's return. Forming risk-sharing partnerships, teams, unique purpose companies, or joint ventures are examples of sharing opportunity. In this case, everyone wins based on their investment and actions.

- Enhance - Enhancing means increasing the risk's likelihood of occurrence and broadening its impact. This is accomplished by identifying and manipulating the various risk triggers. Adding more resources to project activities to complete it sooner is an example of enhancing an opportunity.

- Accept - This entails taking advantage of positive risks as they arise but not actively pursuing them. It's as if an opportunity presented itself and was accepted without much thought.

Negative Risk Management Strategies

- Avoid - Removal of risk by eliminating the source, which may involve not engaging in the activity or altering its execution. The problematic objective can be changed or isolated by the project manager. Information gathering, enhanced stakeholder communication, and expertise utilisation are strategies for risk avoidance. Examples include extending the schedule or altering the project activity's scope. In extreme cases, a risk that poses a severe threat, such as potential harm or death, is avoided by terminating the project entirely.

- Transfer - The Risk Transfer approach involves shifting the risk to a third party. This third party, such as an insurance company or vendor, is compensated to assume or manage the risk on behalf of the project, bearing the ownership and impact of the risk. This transaction often includes a risk premium. Contracts are established to transfer risk liability to the third party. While risk transfer doesn't eliminate the risk, it reduces its direct impact on the project. Tools for transference include insurance policies, performance bonds, warranties, guarantees, and similar mechanisms. This method is particularly effective for mitigating financial risk exposure.

- Mitigate - Mitigation aims to reduce the likelihood of a risk occurring or minimise its impact within acceptable limits. The approach is based on the principle that taking early action to decrease the likelihood or impact of a risk is more effective than addressing it after it happens. Mitigation may involve using advanced technology or best practices to produce higher-quality, defect-free products. Creating a prototype may be necessary to assess the risk level. When reducing the risk's probability is not feasible, identifying linkages determining the risk's severity helps reduce its impact.

- Accept - Acceptance involves acknowledging the risk, especially when no other viable strategy for eliminating it exists. Acceptance can be passive or active. Passive acceptance involves documenting the risk and letting the team address it as it arises. Active acceptance, on the other hand, uses a contingency reserve to recover lost time, money, or resources.

Contingent Risk Response Strategies

Implied strategies come into play only when specific events occur, and they are implemented under certain predefined conditions. Prior to implementation, a wait is observed for sufficient warning signals. These signals may manifest as missing milestones, work items, or deadlines, among other indicators. The strategies encompass the utilisation of financial reserves, reallocating staff, and implementing workarounds to minimise loss, repair damage to the greatest extent possible, and prevent a recurrence.

The Responsibility on Risk Management

Risk management should be implemented by various key stakeholders within the organisation, including:

- Board of Directors: The board of directors plays a crucial role in overseeing risk management practices. They should set the tone for risk management, establish risk appetite, and ensure that appropriate risk management strategies and controls are in place.

- Senior Management: Senior management is responsible for implementing risk management practices throughout the organisation. They should develop and communicate the risk management framework, allocate resources for risk management activities, and integrate risk considerations into decision-making processes.

- Risk Management Department/Officers: Organisations may have dedicated risk management departments or officers who are responsible for coordinating and facilitating risk management activities. They should identify and assess risks, develop risk mitigation strategies, and provide guidance and support to the organisation in managing risks.

- Internal Audit: The internal audit function plays a critical role in evaluating the effectiveness of risk management processes and controls. They should conduct regular audits, assess compliance with risk management policies, and provide independent assurance on the organisation's risk management practices.

- Employees: All employees have a role in implementing risk management. They should be aware of the organisation's risk management policies, report potential risks or incidents, and adhere to established controls and procedures to mitigate risks within their areas of responsibility.

- External Consultants and Advisors: Organisations may engage external consultants or advisors with expertise in risk management to provide guidance, conduct risk assessments, and offer specialised knowledge to enhance risk management practices.

Implementing risk management requires collaboration and coordination among these stakeholders. It should be a collective effort that involves clear roles and responsibilities, effective communication, and a shared commitment to managing risks to achieve the organisation's objectives.

Mastering the Game: Billy Beane's Risky Business in Moneyball

In the cinematic world of Moneyball, Billy Beane emerges as a maverick risk-taker, challenging the conventions of baseball scouting. Billy's risk management strategy wasn't about avoiding risks; it was about redefining them. The conventional approach to player selection relied heavily on subjective judgments and traditional scouting methods. However, Billy, armed with a data-driven mindset, took the plunge into the uncharted waters of sabermetrics. This radical shift in strategy was a gamble, but it was a calculated one.

Billy's risk-taking had a profound impact on the game of baseball. By embracing sabermetrics, he shifted the focus from intuition to statistical analysis. This bold move not only challenged the status quo but also paved the way for a new era in player evaluation. While the traditionalists scoffed at the unconventional approach, the results spoke for themselves. The Oakland Athletics, with limited financial resources, managed to compete against teams with much larger budgets. The impact of Billy's risk management was a paradigm shift that resonated far beyond the baseball diamond.

However, Billy's journey was not without its setbacks. The resistance from traditionalists, skepticism from the baseball establishment, and even internal conflicts within the team presented significant challenges. The risk of alienating key stakeholders and disrupting established norms was a tangible negative consequence. Additionally, the human element, often overlooked in statistical models, led to moments of frustration and doubt. The movie does not shy away from portraying the rough edges of Billy's risk management approach, adding depth to the narrative.

In the end, Billy Beane's risk management style in Moneyball wasn't just about wins and losses; it was about challenging the norm, embracing innovation, and redefining success. The impact of his calculated risks reverberates through the sports world, inspiring a shift towards data-driven decision-making. Entrepreneurs, take note: sometimes, the greatest risks lead to the most profound transformations.

Understanding the Essential Steps in Risk Management

Risk Identification

Being aware of potential hazards is the only way to deal with them effectively. The first stage is to describe the events that may have an impact on your organisation's ability to achieve its goals and assign responsibility for dealing with them. At this point, the four primary areas of risk to consider are:

- Hazard risks - A hazard is something that can cause harm, such as electricity, chemicals, climbing a ladder, noise, a keyboard, a workplace bully, stress, and so on. A risk is the possibility, whether high or low, that a hazard will cause harm to someone.

- Financial risks - Financial risk refers to your company's ability to manage debt and meet financial obligations.

- Strategic risks - A business risk is any risk that arises from senior management's business decisions.

- Operational risks - The potential harm caused by disruptions to day-to-day business operations is referred to as operational risk. These risks can have a financial impact, disrupt business continuity, harm the organisation's reputation, and compromise regulatory compliance. Continuous operational risk management is essential for minimising that harm.

Risk Assessment

The potential severity of the identified risks must be assessed. It is necessary to evaluate the likelihood and impact of the risks, as some have the potential to destroy the company while others may be minor annoyances.

It is now common practice to use risk matrices as visual aids to evaluate the likelihood of hazards occurring and the severity of their potential consequences. It is critical to determine which hazards require additional attention and how quickly you must act to limit the damage.

Risk Treatment

Your risk management strategy is your plan for dealing with potential threats. You can do this in one of four ways:

- Avoiding a potential danger is the best way to deal with it.

- When risk is assigned to another group or organisation, it is transferred.

- Reduce or eliminate the threat's impact as soon as possible by taking preventative measures.

- Accept the risk with all of its potential consequences, or plan for its management accordingly.

The level of specificity in your response plan for each risk should be equal to the magnitude of the issue and thus prioritised.

Risk Monitoring

Risk management should be viewed as an iterative rather than a linear process. Whoever accepts the risk will be responsible for monitoring it and informing the rest of the company of any developments. An issue that appears unlikely to have an impact on your company one month may become a major concern the next. The key is to keep lines of communication open at all times to avoid unpleasant surprises down the road.

Risk Reporting

Reporting at each of the four stages mentioned above is critical for effective risk management and decision-making. Furthermore, in order to better understand whether current techniques are adequate, this exercise should help to justify any changes or revisions. Early in the risk management process, you should define the reporting framework by deciding on the type and format of reports to be generated, as well as how frequently they will be generated.

McDonalds's Risk Management Journey

In the intricate ballet of entrepreneurship portrayed in "The Founder," Ray Kroc emerges as a risk management maestro. His journey is a rollercoaster of calculated gambles and strategic moves. Ray's ability to navigate the turbulent waters of business risk is evident in his early decision to take on the franchise model. However, this wasn't without its challenges. While the franchise model offered rapid expansion, it also exposed the brand to the complexities of decentralized operations and varying management styles. Ray's risk appetite, though, proved instrumental in the widespread success of McDonald's, transforming it from a local gem to a global giant.

Yet, this risk-taking journey wasn't without its shadows. The movie sheds light on the strain it placed on Ray's relationships, particularly with the original McDonald brothers. The tension arising from differences in business philosophies and the impact of decentralized franchising revealed the darker side of risk. Ray's bold choices strained the bonds that initially held the golden arches together. The movie portrays the inevitable clash between entrepreneurial ambition and the preservation of the original vision, emphasising the high stakes involved in managing risk.

Additionally, Ray's risk management prowess also toes the ethical tightrope. The movie hints at instances where his pursuit of success overrides ethical considerations, particularly in his dealings with the McDonald brothers. This duality of risk-taking, both admirable in its business acumen and questionable in its ethical dimensions, adds complexity to Ray's character. It prompts viewers to ponder the moral cost of entrepreneurial success and the fine line between calculated risk and ethical compromise.

As the credits roll, the impact of Ray's risk management strategy unfolds. McDonald's stands as an enduring symbol of success, but not without scars from the battles fought. The franchise model, while a key driver of growth, brought both prosperity and challenges. Ray's legacy is one of triumph and tribulation, showcasing the dynamic interplay between risk and reward in the tumultuous world of entrepreneurship.

The Importance of Risk Management in Corporate Governance

A risk management strategy can benefit any business, regardless of size or industry. Instead of viewing risk management strategy as a series of discrete tasks, consider it as an iterative process in which new and existing risks must be continuously detected, analyzed, managed, and monitored. It enables continuous assessment and response, ensuring that the company's people, property, and resources are always safe.

Implementing risk management is crucial for organisations due to the following reasons:

- Protection of Stakeholder Interests: Risk management ensures the protection of stakeholder interests, including shareholders, employees, customers, and business partners. By identifying and mitigating risks, organisations can minimise potential harm, prevent financial losses, and maintain stakeholder confidence.

- Preservation of Reputation: Effective risk management helps preserve the organisation's reputation. By proactively addressing risks, organisations can avoid negative incidents, scandals, or compliance breaches that may damage their image and brand. Protecting reputation is vital for attracting investors, customers, and talent.

- Enhanced Decision-Making: Risk management provides decision-makers with valuable insights and information. It enables them to make informed choices by considering potential risks, weighing potential rewards, and assessing the impact of decisions on the organisation's objectives. This leads to more effective and strategic decision-making.

- Financial Stability: Implementing risk management practices contributes to the financial stability of the organisation. By identifying and managing financial risks, organisations can avoid financial crises, minimise losses, and protect the organisation's assets, liquidity, and profitability.

- Compliance with Regulations: Risk management ensures compliance with laws, regulations, and industry standards. By identifying and addressing compliance risks, organisations can avoid legal penalties, fines, and reputational damage. Compliance is essential for maintaining the organisation's integrity and credibility.

- Efficient Resource Allocation: Risk management enables organisations to allocate resources efficiently. By understanding and managing risks, organisations can prioritise their resources, invest in areas with acceptable risk levels, and optimise operational efficiency. This leads to cost savings and better resource utilisation.

- Resilience and Business Continuity: Implementing risk management practices enhances the organisation's resilience and ability to withstand unexpected events. By planning for potential risks and developing contingency plans, organisations can minimise disruption, recover quickly from incidents, and ensure business continuity.

- Improved Stakeholder Relationships: Effective risk management builds trust and improves relationships with stakeholders. By demonstrating a proactive approach to risk management, organisations show their commitment to the well-being of stakeholders, leading to increased confidence, loyalty, and support.

- Opportunity Identification: Risk management enables organisations to identify and capitalise on opportunities. By evaluating risks and their potential rewards, organisations can make strategic decisions to pursue favorable opportunities while managing associated risks. This fosters innovation, growth, and competitive advantage.

- Long-Term Sustainability: Implementing risk management practices contributes to the long-term sustainability of the organisation. By addressing risks related to environmental, social, and governance (ESG) factors, organisations can operate responsibly, adapt to changing circumstances, and create value in a sustainable manner.

Overall, implementing risk management is essential for protecting stakeholder interests, preserving reputation, making informed decisions, ensuring financial stability, complying with regulations, and fostering resilience. It contributes to the organisation's long-term success and sustainability in an increasingly complex and uncertain business environment.

Implementing Risk Management in Corporate Governance

To implement risk management effectively, organisations can follow these steps:

- Establish a Risk Management Framework: Develop a risk management framework that outlines the organisation's approach to identifying, assessing, and managing risks. This framework should define roles, responsibilities, and reporting structures for risk management activities.

- Identify and Assess Risks: Conduct a comprehensive risk assessment to identify potential risks that may affect the organisation's objectives. This involves analysing internal and external factors, engaging relevant stakeholders, and using appropriate risk assessment tools and techniques.

- Set Risk Appetite: Define the organisation's risk appetite, which represents the level of risk the organisation is willing to accept in pursuit of its objectives. This helps guide decision-making and establishes boundaries for risk-taking within the organisation.

- Develop Risk Mitigation Strategies: Based on the identified risks, develop strategies to mitigate, avoid, transfer, or accept them. This may involve implementing controls, developing contingency plans, and establishing monitoring mechanisms to track the effectiveness of risk mitigation efforts.

- Integrate Risk Management into Decision Making: Embed risk management into the organisation's decision-making processes. Ensure that risk assessments and considerations are systematically integrated into strategic planning, project management, and operational activities.

- Implement Controls and Policies: Establish robust internal controls and policies to mitigate identified risks. This includes implementing procedures, guidelines, and protocols that address specific risk areas and ensure compliance with applicable laws, regulations, and industry standards.

- Monitor and Review: Continuously monitor and review the effectiveness of risk management measures. Regularly assess the status of identified risks, evaluate control effectiveness, and update risk profiles as new risks emerge or existing risks evolve.

- Communicate and Report: Communicate risk management information to relevant stakeholders. This includes providing regular updates on the organisation's risk profile, risk mitigation efforts, and any significant changes or incidents. Transparent and timely communication helps stakeholders understand the organisation's risk landscape.

- Training and Awareness: Provide training and raise awareness among employees about risk management practices and their roles in managing risks. Foster a risk-aware culture where employees are encouraged to report potential risks and contribute to risk management initiatives.

- Continuous Improvement: Foster a culture of continuous improvement in risk management. Regularly evaluate the effectiveness of the risk management framework, learn from past experiences, and incorporate lessons learned into future risk management activities.

By implementing these steps, organisations can establish a robust risk management framework within their corporate governance structure. This helps mitigate risks, enhance decision-making, and safeguard the organisation's long-term success and stakeholder interests.

Risk Mismanagement: The Downfall of AEY and Ephraim

In the chaotic world of arms dealing portrayed in "War Dogs," AEY, led by the charismatic yet reckless Ephraim Diveroli, embarked on a perilous journey marked by a series of risk mismanagement. The duo's failure to adequately assess and mitigate risks stemmed from their overconfidence and the allure of quick profits. Ephraim's audacious approach, while initially successful, lacked a comprehensive risk management strategy. They underestimated the complexities of the arms industry, leading to a cascade of challenges that ultimately shook the foundation of AEY.

The repercussions of AEY and Ephraim's risk mismanagement were profound. What initially seemed like a golden opportunity turned into a house of cards. In their pursuit of lucrative government contracts, they became entangled in a web of legal, ethical, and logistical challenges. The impact rippled through their business, tarnishing its reputation and leading to financial and legal woes. The lack of a robust risk management framework not only jeopardized AEY's existence but also left a trail of consequences for those involved, including damaged relationships and a tainted legacy.

AEY and Ephraim's story in "War Dogs" serves as a cautionary tale for entrepreneurs. It highlights the importance of meticulous risk management in volatile industries. Overlooking risks, driven by the desire for quick success, can lead to a catastrophic downfall. The impact goes beyond financial losses; it extends to the very fabric of the business and the lives of those involved. Aspiring entrepreneurs, take note: the allure of high rewards should always be tempered with a strategic and comprehensive approach to risk management to navigate the turbulent waters of business.

How to Enhance Corporate Governance Through Proactive Risk Management

In summary, effective risk management is a critical component for businesses aiming to secure their longevity and navigate the complexities of the dynamic business landscape. The first key takeaway emphasises the importance of thorough risk assessments. By analysing internal and external factors, including financial, operational, and strategic considerations, businesses can identify potential vulnerabilities and challenges. This proactive approach enables organisations to develop strategies for mitigating risks before they escalate, fostering resilience and adaptability.

The second takeaway underscores the significance of establishing robust risk management processes and frameworks. This involves implementing preventive measures, such as internal controls and contingency plans, to minimise the impact of identified risks. Creating a risk-aware culture within the organisation is equally crucial. When employees at all levels are encouraged to stay vigilant and report potential risks promptly, it creates a proactive environment that enhances the organisation's ability to address challenges effectively.

The third takeaway highlights the need for ongoing monitoring and adaptation. Given the ever-evolving nature of the business environment, regular reassessment of risks is essential. Businesses should integrate risk management seamlessly into their decision-making processes, ensuring that it becomes a fundamental aspect of strategic planning. By doing so, organisations empower themselves to make informed decisions, navigate uncertainties with confidence, and ultimately position themselves for sustained success in the long term.

Join the Conversation: Share Your Thoughts on This Article

- No comments yet.

Add Your Comment Now!