SME Corporate Governance Best Practices: Corporate governance case studies

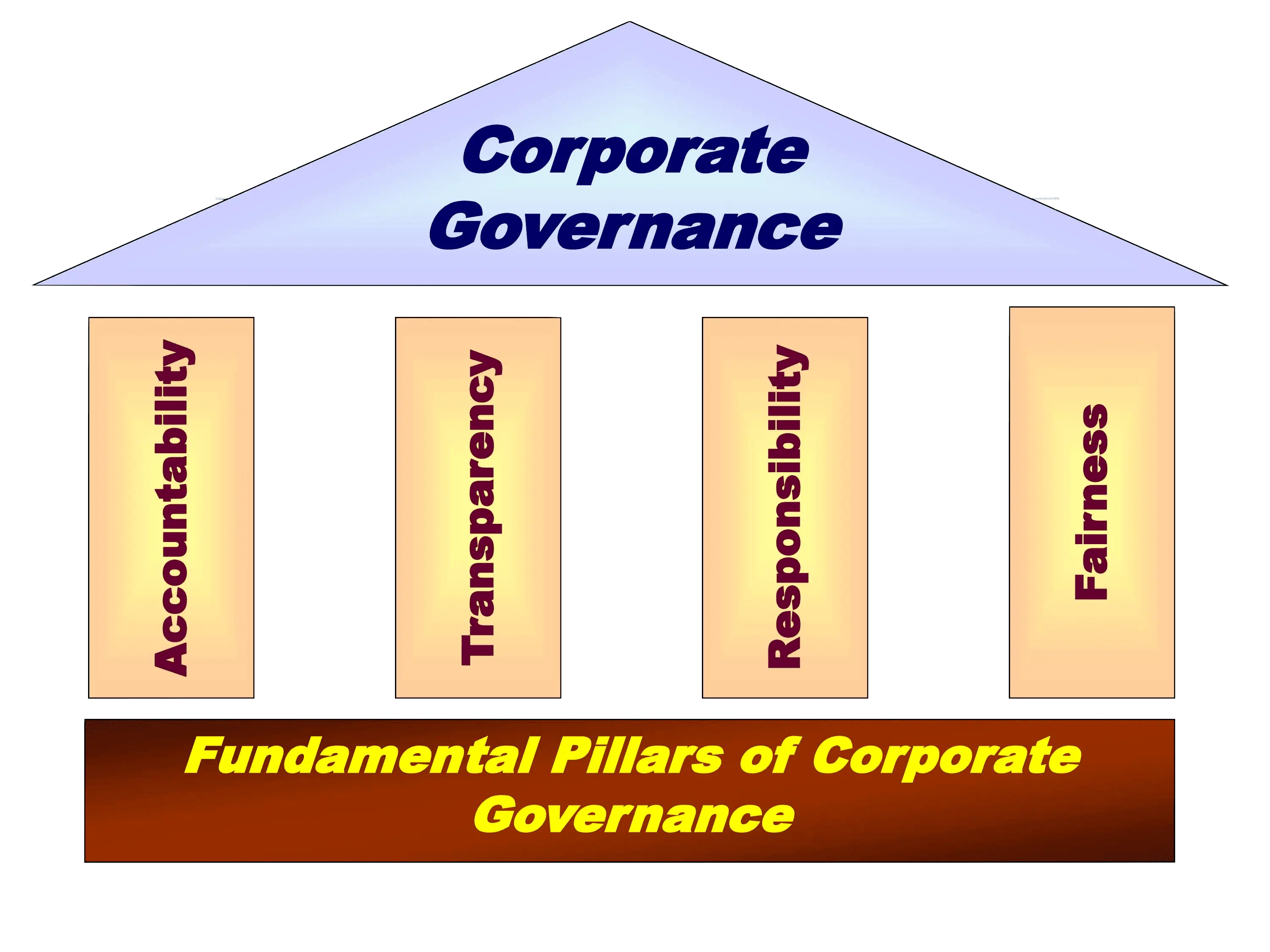

Master the essentials of corporate governance with our comprehensive guide. Explore the critical components, from establishing a clear governance structure to fostering a culture of accountability and transparency. Learn how to implement ethical practices, adhere to a code of conduct, and communicate openly with stakeholders.

Corporate Governance Case Studies Vital for SMEs

Discover how corporate governance case studies serve as invaluable guides for SMEs navigating complex business landscapes. Explore real-world scenarios showcasing best practices, pitfalls, and strategies employed by successful enterprises to achieve sustainable growth and mitigate risks. By delving into these case studies, SMEs gain practical insights into effective decision-making, transparency, and accountability, fostering a culture of integrity and compliance within their organizations. From governance structures to ethical dilemmas, these studies illuminate the path towards enhanced operational efficiency, investor trust, and long-term viability.

Corporate Governance Best Practices: Corporate Governance Case Studies Demystified

- Delve into the significance of corporate governance through insightful case studies. Explore real-world examples showcasing the impact of effective governance practices on organizational performance, stakeholder trust, and long-term sustainability. Gain valuable insights into regulatory compliance, ethical standards, and risk management strategies. Whether you're a corporate leader, investor, or governance enthusiast, understanding these case studies illuminates the importance of robust governance frameworks in fostering transparency, accountability, and responsible business conduct. Enhance your knowledge and sharpen your decision-making skills by immersing yourself in these illuminating narratives of corporate governance in action.

- Furthermore, this comprehensive corporate governance case studies emphasize the role of effective risk management and compliance measures. Analysing instances where companies successfully navigated challenges by implementing robust internal controls and compliance frameworks can guide businesses in identifying potential risks and developing preventive strategies. Ultimately, the takeaway lies in the integration of sound governance practices, ethical conduct, and risk management, positioning businesses for sustainable growth and resilience in a rapidly changing business landscape.

Corporate governance case studies

Written by: Malose Makgeta

MBA with 20+ years experience in SME development and funding. LinkedIn Profile

Corporate Governance Lessons from McDonald's, War Dogs and Oakland A's

- The Founder (McDonald's): The success of McDonald's can be attributed to the astute application of effective management and control principles. The McDonald brothers, Richard and Maurice, pioneered a revolutionary approach by introducing a streamlined and efficient fast-food system at their original San Bernardino restaurant. Their focus on a standardized menu, efficient kitchen layout, and a systematic assembly line process exemplified a commitment to operational excellence and clear organisational structure. Ray Kroc, recognising the potential for scalability and standardisation, played a pivotal role in transforming McDonald's into a global franchise. His emphasis on maintaining quality control through strict franchise agreements, standardized procedures, and centralised supply chain management showcased a keen understanding of the importance of management and controls in ensuring consistency and reliability across the expanding network. Together, the McDonald brothers and Ray Kroc demonstrated the application of sound management principles, setting a benchmark for the fast-food industry and beyond.

- War Dogs (AEY): the portrayal of AEY's corporate governance is characterised by a lack of transparency, ethical concerns, and a disregard for legal regulations. The company, led by Efraim Diveroli, engages in arms dealing with the U.S. government in a manner that raises ethical questions and breaches the principles of responsible corporate governance. AEY's business practices involve exploiting loopholes and questionable tactics to secure government contracts, contributing to a culture of risk and irresponsibility. The absence of proper checks and balances within the company's governance structure is evident as it becomes embroiled in illicit activities. Overall, the film suggests that AEY's corporate governance is flawed, emphasising the importance of ethical conduct and adherence to regulations in business operations.

- Moneyball (Oakland A's): The Oakland Athletics, under the unconventional leadership of Billy Beane, applied principles akin to effective corporate governance in their groundbreaking approach portrayed in "Moneyball." Beane, as the general manager, redefined the team's strategy by emphasising data-driven decision-making and analytics. This represented a structural shift in the traditional approach to scouting and player selection in baseball. Beane's approach demonstrated a commitment to transparency and accountability to achieve success on a constrained budget. By challenging conventional norms and embracing innovative practices, the A's, under Beane's leadership, exemplified the importance of adapting governance principles to achieve long-term success and competitiveness in the dynamic and highly competitive realm of professional sports.

CONTEXT

How to improve your corporate governance is about Identifying and mitigating numerous risks associated with a project. Managers who anticipate and plan for common business risks are more likely to avoid pitfalls. This skills programme covers the King IV in the context of SMMEs, as well as how to improve corporate governance in terms of defining roles, reporting and disclosure, corporate social responsibility, and risk governance. This skills programme provides entrepreneurs and business managers with a platform and tools for identifying and managing business risks.

Corporate governance case studies lessons from case studies:

Lessons from The Founder - McDonalds

Movie Description

The Founder is one amazing movie and is a must watch for every entrepreneur. It not only gives you life lessons and but also few path breaking business lessons. The Founder is story of Ray Crock. How a 52-year-old sales man turned two brothers (McDonald Brothers) small eatery into the world’s biggest restaurant business. McDonald brothers had invented the speedy system a process to deliver food in seconds but couldn’t develop business beyond their one restaurant. This is Ray Crock comes re-imagines the whole fast food business and created the McDonald Corporation we see today.

Expected Outcomes

The Founder is jam-packed with practical business advice. It pulls back the curtain to reveal the secrets of Ray Krocs transformation of McDonalds into one of the worlds largest fast food restaurants. Entrepreneurs and business owners will discover: “Nothing in this world can take the place of persistence. Talent wont; nothing is more common than unsuccessful men with talent. Genius wont; unrewarded genius is practically a cliché. Education wont; the world is full of educated fools. The purpose of this case study is to provide a practical case study on how to build a business in the manufacturing sector—that is, a business that takes raw materials and adds value to them to produce a product.

Rational

Ray Kroc, a 52-year-old over-the-hill salesman struggling to sell multimixers, turned two brothers innovative fast food eatery, McDonalds, into the worlds largest restaurant business through a combination of ambition, persistence, and ruthlessness. If you are a small business owner looking to learn about scaling, franchising, and brand building, McDonalds is the one business to look to as a reference, as they have done this incredibly well. They are a true American business success story and icon. The story of how McDonalds came to be is told in a new film, The Founder, and we learn the true story of Ray Kroc, the traveling salesman who is credited with making McDonalds what it is today, and its original founders, Richard and Maurice McDonald.

Key Lesson

None

Click here and draft your business plan in minutes

To request tailored accredited training and enterprise development services, contact us at businessplan@superdealmaker.com.

Get List for Funding Opportunities in Minutes, Click Here

To request tailored investment banking services, contact us at businessplan@superdealmaker.com.

Risk Management in the Early Days of McDonald's

In the early days of McDonald’s, operational risks were mitigated through the implementation of standardized processes and stringent quality control measures. The introduction of the "Speedee Service System" ensured that each product met specific quality standards, reducing variability in food and service. Regular maintenance schedules and staff training on equipment usage further minimized the risk of service interruptions due to equipment failure. This focus on consistency and reliability in operations was crucial for establishing McDonald's reputation for fast and dependable service.

Supply chain risks were managed by building strong relationships with multiple suppliers and insisting on high-quality ingredients. This approach ensured a steady supply of necessary ingredients, reducing the likelihood of shortages or inconsistencies. Inventory control systems and just-in-time inventory practices balanced supply and demand, preventing both overstock and understock situations. By localizing their supply chain, the McDonald brothers minimized dependencies on distant suppliers, thereby enhancing the stability and reliability of their ingredient sourcing.

Financial risks, particularly cash flow issues and franchising challenges, were addressed through meticulous expense management and reinvestment of profits. McDonald's employed a cash-based model to avoid credit risks, maintaining financial stability. For franchising, stringent selection criteria were established to ensure franchisees had the necessary financial stability and operational capability. The support and training provided to franchisees helped maintain the overall quality and success of the brand, mitigating risks associated with financial instability among franchise partners.

Market risks, including competition and changing consumer preferences, were managed through strategic branding and menu innovation. McDonald's differentiated itself with a strong brand identity focused on speed, consistency, and a family-friendly atmosphere. Regular updates to the menu, based on customer feedback and market trends, kept the offerings fresh and appealing. Legal and regulatory risks were mitigated by adhering to health and safety regulations and protecting intellectual property. This comprehensive approach to risk management in the early days laid a solid foundation for McDonald's enduring success and global expansion.

Lesson on Corporate Governance from McDonald's

- The importance of transparent decision-making: The movie highlights the significance of transparent decision-making. Ray Kroc's lack of transparency and hidden agendas ultimately lead to conflicts and strained relationships with stakeholders.

- Effective communication with stakeholders: "The Founder" emphasises the need for effective communication between corporate leaders and stakeholders. Clear and open communication helps build trust, alignment, and a shared understanding of goals and expectations.

- Ethical behavior and integrity: The movie showcases the importance of ethical behavior and integrity. Ray Kroc's questionable actions, such as going against verbal agreements and disregarding stakeholder interests, demonstrate the negative consequences of unethical conduct.

- Accountability and responsibility: Corporate governance requires accountability and responsibility. In the movie, the McDonald brothers hold themselves accountable for their business decisions and prioritise the well-being of their stakeholders.

- Balancing long-term sustainability with short-term gains: "The Founder" highlights the need for corporate governance to strike a balance between short-term gains and long-term sustainability. Ray Kroc's relentless pursuit of expansion and profit ultimately leads to negative consequences and a compromised corporate culture.

- Board oversight and governance structures: The movie showcases the importance of board oversight and effective governance structures. Having a robust governance framework can help prevent abuses of power and ensure ethical decision-making.

- Stakeholder engagement and involvement: The movie emphasises the value of stakeholder engagement and involvement. The McDonald brothers' focus on understanding and meeting stakeholder needs fosters a stronger and more sustainable business.

- Transparency in financial matters: The movie highlights the importance of financial transparency. Ray Kroc's manipulation of financial records and contracts demonstrates the negative consequences of hiding information and misleading stakeholders.

- Legal compliance and adherence: "The Founder" underscores the significance of legal compliance and adherence to regulations. Non-compliance can lead to legal issues, damaged reputation, and loss of stakeholder trust.

- Respecting intellectual property and agreements: The movie showcases the importance of respecting intellectual property rights and honoring agreements. Ray Kroc's disregard for the original McDonald's concept and the brothers' intellectual property leads to conflicts and legal battles.

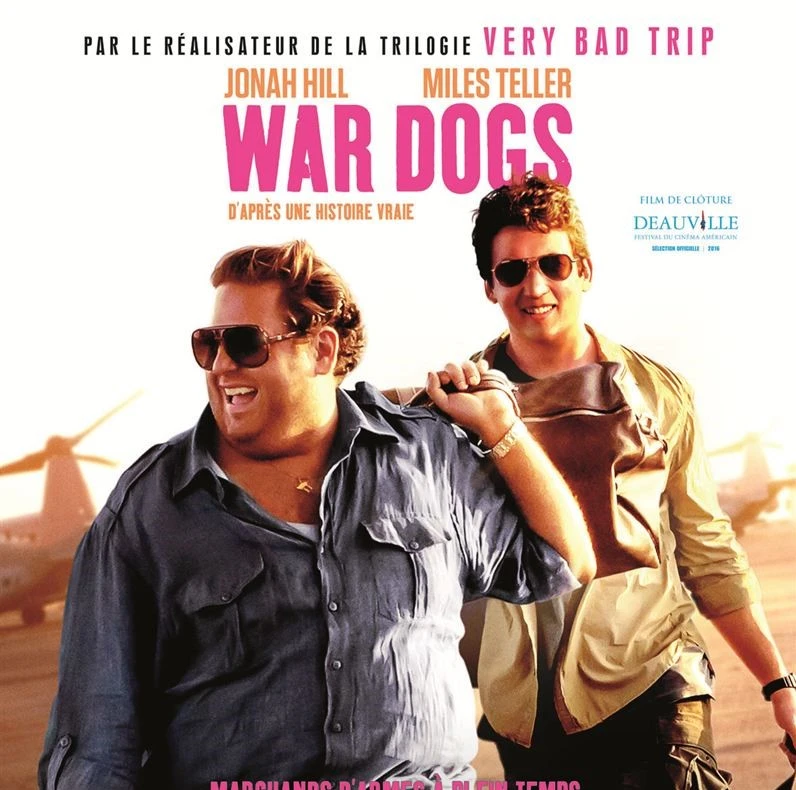

Lessons from War Dogs - AEY

Movie Description

War Dogs is based on one of those true stories that no one would actually believe if it were written as fiction. In the mid-’00s, two kids named Efraim Diveroli and David Packouz managed to secure a $300 million contract with the United States government to supply allied forces in Afghanistan with arms and ammunition. They then embarked on a globetrotting misadventure that saw them dealing with shady crooks and corrupt politicians and dangerous soldiers in the name of making a fortune. Most astonishingly, both men were twenty something stoners with no experience handling anything of this size or scope. As much as the film may diverge from the truth for the sake of cinematic drama, the core story remains jaw-droopingly true.

Expected Outcomes

There are several important lessons that any aspiring new entrepreneur can learn from Hollywoods portrayal of business in these business movies. Two friends embark on that journey, and they do what any excited real entrepreneur or business manager would do: they hustle, work like dogs, read and study all night, and have a do-whatever-it-takes attitude. If a deal is about to fall apart, they hustle even harder and manage to keep it together. The purpose of the case study is to provide a practical case study on how to build a business in the facilitated network sector, which makes money by allowing people to exchange information, products, and services.

Rational

Entrepreneurs are constantly learning on the job, from their peers to their idols, and, most importantly, from their own mistakes—the road to owning your own business is littered with lessons learned. However, learning some of these lessons before embarking on your own journey only makes the process easier. i.e. Cutting corners can be an expensive proposition - Finding the best deals can be wise but make sure that you consider long-term costs and the time that you might have to invest to fix problems.

Key Lesson

None

Lesson on Corporate Governance from "War Dogs"

- Compliance and Ethics: The movie "War Dogs" highlights the importance of adhering to legal and ethical standards.

- Transparency and Accountability: The film emphasises the need for transparency in business operations and accountability to stakeholders.

- Risk Management: "War Dogs" showcases the significance of identifying and managing risks effectively to protect the interests of the company and stakeholders.

- Board Oversight: The movie underscores the role of a responsible and active board of directors in overseeing the company's activities and decision-making processes.

- Stakeholder Engagement: "War Dogs" demonstrates the value of engaging with stakeholders to understand their needs, manage their expectations, and maintain positive relationships.

- Conflict of Interest: The film highlights the detrimental effects of conflicts of interest on corporate governance, urging individuals to act in the best interest of the company and its stakeholders.

- Corporate Social Responsibility: "War Dogs" raises awareness of the importance of considering social and environmental impacts while conducting business, promoting responsible corporate citisenship.

- Strategic Decision-Making: The movie showcases the significance of informed and strategic decision-making processes, taking into account long-term goals and potential consequences.

- Compliance Programs: "War Dogs" illustrates the need for robust compliance programs to ensure adherence to laws and regulations, mitigating legal and reputational risks.

- Internal Controls: The film highlights the role of effective internal controls in preventing fraud, corruption, and other misconduct within the organisation.

Corporate Governance failure

On March 27, 2008, the U.S. government suspended AEY Inc. for violating the terms of its contract; the company was charged with providing ammunition made in China to the Afghan National Army and police in violation of an earlier arms embargo. According to United States Army records, the business received more than $200 million in contracts in 2007 to provide ammunition, rifles, and other weapons. The United States Army started reviewing its contracting practices as a result of the publicity surrounding the contract.

The ammunition was deemed "unserviceable" by the US House Committee on Oversight and Government Reform. Additionally, AEY had broken numerous previous contracts, such as failing to deliver 10,000 Beretta pistols to Iraq and sending potentially dangerous helmets.

Extract from the court proceedings - "Today's hearing examines a $300 million contract to supply ammunition to the Afghan Security Forces. This contract is an important one because it relates directly to the success of our mission in Afghanistan. We know a lot about what went wrong after the contract to AEY was awarded in January 2007. We know that ammunition provided by AEY was unserviceable. We know that much of the ammunition was illegal, Chinese-made ammunition. We know that after paying AEY over $60 million, the Army canceled the contract. And we know that last week the Justice Department indicted AEY and its top officials with 71 counts of fraud and related charges."

Don’t do unethical things unless you are prepared to go all the way

The main character in this book was definitely a sociopath and evil, but his partner was not. Nonetheless, he directed his partner to engage in unethical behavior. Forging documents and financial statements was one of the unethical things he had him do. He always assumed that all I had to do was forge the final set of documents, and that was the end of it. He also saw the main character screw over people and never imagined it would be him. Surprise the unethical deeds did not stop, and he got screwed over.

This lesson is always relevant in public accounting. Don't believe that just because other people do unethical things, you can get away with it. Also, don't do unethical things because you believe it will be the last time.

You don't want your name in the news because you assumed unethical behavior would stop on its own. Everyone involved in the unethical business situations mentioned above assumed no one was looking. They also believed that none of the bad behavior would ever be exposed. On the front page, their names have been dragged through the mud.

Lesson on Corporate Governance from Oakland A's"

- Utilise data-driven decision-making: In "Moneyball," the concept of using statistical analysis to evaluate player performance revolutionised the way the Oakland Athletics approached team building. This highlights the importance of incorporating data and analytics in corporate decision-making processes.

- Challenge conventional wisdom: Billy Beane, the general manager of the Oakland Athletics, challenged traditional scouting methods and relied on data-driven insights instead. This teaches us the value of questioning established practices and exploring innovative approaches to corporate governance.

- Focus on long-term strategy: Rather than solely focusing on short-term gains, "Moneyball" emphasises the importance of developing a long-term strategy for sustainable success. This lesson translates into corporate governance by encouraging organisations to prioritise long-term goals over immediate gains.

- Embrace diversity and inclusion: "Moneyball" showcases how a diverse team, comprising players undervalued by other teams, can achieve remarkable results. This underscores the significance of diversity and inclusion, promoting varied perspectives and innovative thinking.

- Transparent and effective communication: Effective communication is key to successful corporate governance. The movie highlights the importance of transparent and open communication among team members, fostering trust, collaboration, and alignment towards shared objectives.

- Adaptability and agility: "Moneyball" demonstrates the need for adaptability and agility in the face of changing circumstances. This lesson translates into corporate governance by emphasising the importance of staying flexible and responsive to market dynamics and emerging opportunities.

- Collaboration and teamwork: Building a successful team in "Moneyball" required collaboration and teamwork, where individual contributions were aligned with collective goals. Similarly, effective corporate governance involves fostering a collaborative culture that encourages teamwork and harnesses individual talents.

- Accountability and responsibility: "Moneyball" highlights the significance of individual accountability and responsibility in achieving organisational objectives. Corporate governance should promote a culture of accountability, where individuals are held responsible for their actions and decisions.

- Risk management: The movie emphasises the need to assess and manage risks effectively. Corporate governance should incorporate robust risk management practices to identify, assess, and mitigate potential risks that could impact the organisation's success.

- Ethical decision-making: "Moneyball" prompts discussions about ethical decision-making in the face of business pressures. Corporate governance should prioritise ethical conduct, ensuring decisions and actions align with ethical standards and legal requirements.

Accountability and ownership: Leaders are the first to accept responsibility and accountability for failure. They are ultimately responsible.

Billy Beane is pressured to take a risk and do something no team has ever done before — abandon conventional recruiting techniques and use computer-generated analysis to acquire and trade players. This is because teams like the New York Yankees and the Cleveland Indians have large budgets and high-profile players. And in doing so, he permanently altered the game's appearance and setting.

Billy Bean transformed Oakland Athletics from a struggling team to a stunning success by employing this new strategy, shocking the sports world. They were able to transform what appeared to be a slow but certain death into an amasing string of victories. At the conclusion, the team with the worst record in Major League Baseball the previous season, the Oakland Athletics, sets a new record for the American League by winning 20 straight games, a feat never before accomplished in the league's 103-year history, and all while operating on one of the lowest budgets. Moneyball not only teaches readers many important business lessons, but it also sheds light on leadership, change-making, and how to carry out a strategic plan.

In many ways, Billy Beane's challenges in 2001 are frighteningly similar to those faced by many organisations today, especially given the ever-changing economic and people landscape. Our leaders are increasingly being asked to do more (or, at the very least, the same) with less. Less money, fewer resources, and fewer people were the messages given to Billy Beane by the Oakland A's owners prior to the 2002 season. Simon Sinek shared a single line on his LinkedIn page: lack of time + lack of resources + optimism = innovation. The Oakland A's are a perfect example of living out this algorithm 20 years before Simon Sinek brought it to the table!

Corporate Governance Case Studies Key Takeaways:

In dissecting corporate governance case studies, businesses can distill valuable takeaways for their own operational enhancement. Firstly, a meticulous examination of successful cases underscores the pivotal role of a well-structured governance framework. Companies that have excelled often showcase a clear delineation of responsibilities, fostering accountability and strategic alignment among key stakeholders. This reinforces the significance of establishing governance structures that not only comply with regulatory standards but also serve as strategic assets guiding decision-making and organisational conduct.

Secondly, the case studies spotlight the critical importance of ethical conduct within corporate governance. Businesses can draw lessons from instances where companies upheld a robust code of ethics, emphasising transparency, integrity, and responsible decision-making. By integrating ethical considerations into the governance fabric, organisations can build trust, enhance their reputation, and cultivate a positive organisational culture that resonates with both employees and external stakeholders.

Lastly, an essential takeaway lies in the proactive management of risks and compliance. Successful case studies often showcase companies that adeptly identified potential risks, implemented preventive measures, and established compliance frameworks to navigate challenges. Businesses can learn from these examples to fortify their own risk management strategies, ensuring a resilient and adaptive approach to the uncertainties of the business environment. Ultimately, the synthesis of effective governance structures, ethical conduct, and proactive risk management emerges as a blueprint for businesses aspiring to not only meet regulatory requirements but to thrive in a complex and dynamic marketplace.

Join the Conversation: Share Your Thoughts on This Article

- No comments yet.

Add Your Comment Now!